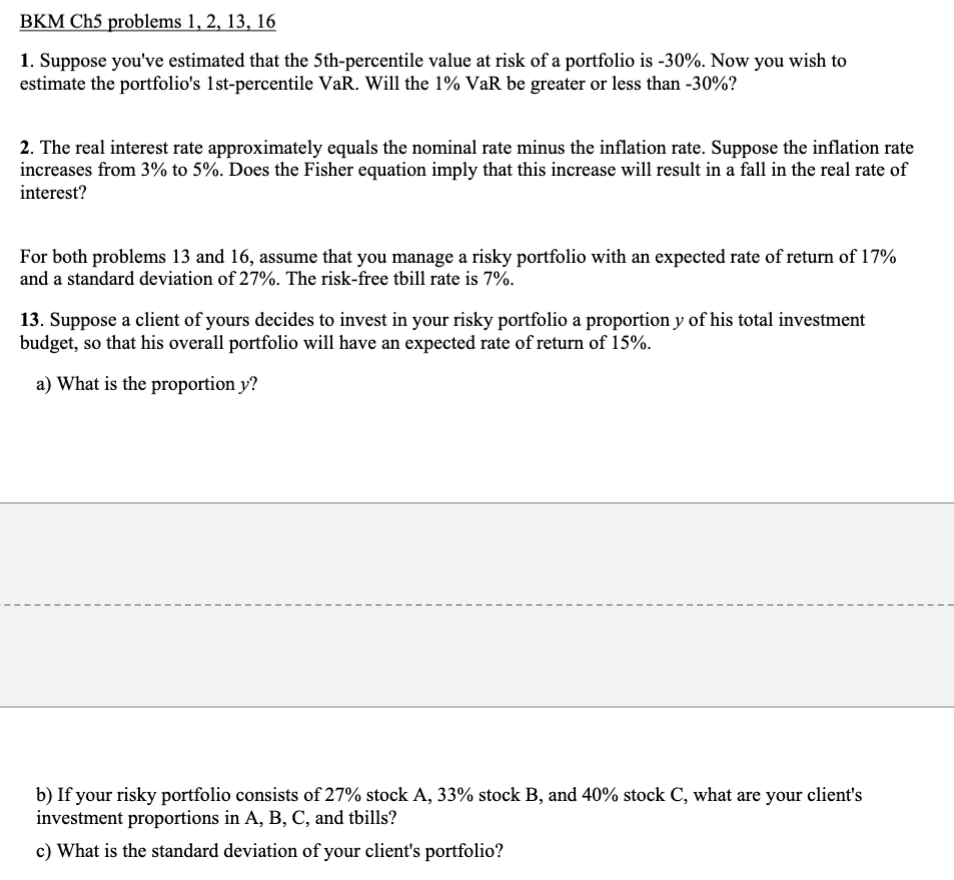

Question: BKM Ch 5 problems 1 , 2 , 1 3 , 1 6 Suppose you've estimated that the 5 th - percentile value at risk

BKM Ch problems

Suppose you've estimated that the thpercentile value at risk of a portfolio is Now you wish to

estimate the portfolio's stpercentile VaR. Will the VaR be greater or less than

The real interest rate approximately equals the nominal rate minus the inflation rate. Suppose the inflation rate

increases from to Does the Fisher equation imply that this increase will result in a fall in the real rate of

interest?

For both problems and assume that you manage a risky portfolio with an expected rate of return of

and a standard deviation of The riskfree tbill rate is

Suppose a client of yours decides to invest in your risky portfolio a proportion of his total investment

budget, so that his overall portfolio will have an expected rate of return of

a What is the proportion

b If your risky portfolio consists of stock stock B and stock C what are your client's

investment proportions in and tbills?

c What is the standard deviation of your client's portfolio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock