Question: (bl (Cl (Ell (El (0 (9) Explain what the given beta implies for UEB's view of the investments co-movement with the market. Do you think

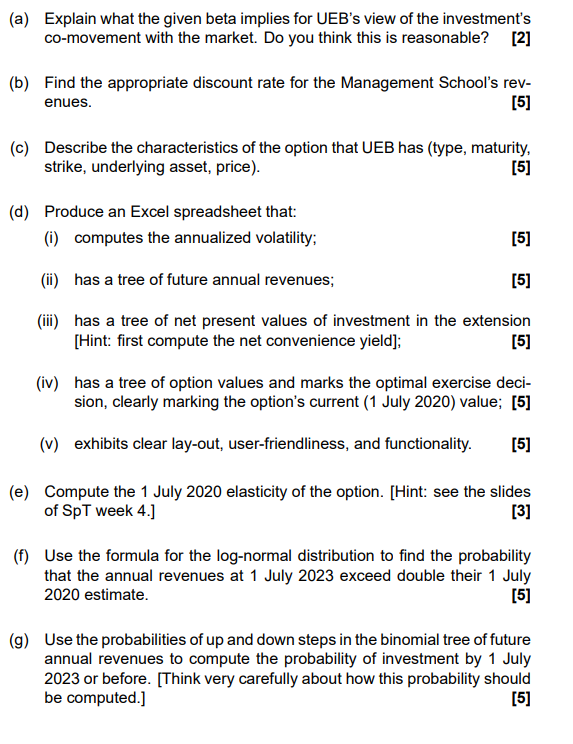

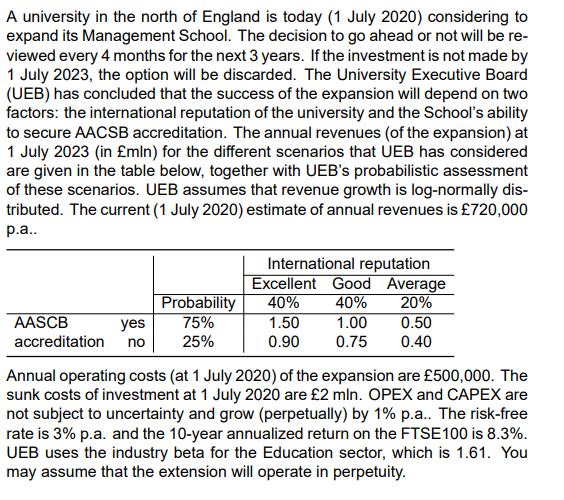

(bl (Cl (Ell (El (0 (9) Explain what the given beta implies for UEB's view of the investments co-movement with the market. Do you think this is reasonable? [2] Find the appropriate discount rate for the Management School's rev- enues. [5] Describe the characteristics of the option that UEB has (type. maturity, strike. underlying asset. price). [5] Produce an Excel spreadsheet that: (i) computes the annualized volatility: [5] {ii}: has a tree of future annual revenues; [5] iii has a tree of net resent values of investment in the extension p [Hint: rst compute the net convenience yield]; [5] (iv) has a tree of option values and marks the optimal exercise deci- sion. cleady marking the option's current (1 July 2020) value; [5] (v) exhibits clear lay-out, user-friendliness, and functionality. [5] Compute the 1 July 2020 elasticity of the option. [Hint: see the slides of SpT week 4.] [3] Use the formula for the log-normal distribution to nd the probability that the annual revenues at 1 July 2023 exceed double their 1 July 2020 estimate. [5] Use the probabilities of up and down steps in the binomial tree of future annual revenues to compute the probability of investment by 1 July 2023 or before. rl'hink very carefully about how this probability should be computed] [5| \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts