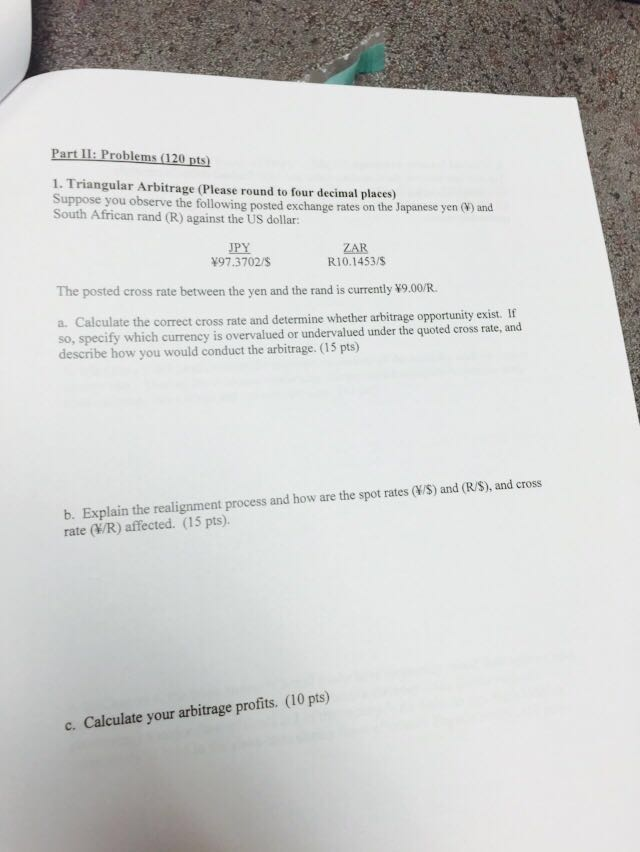

Question: bl ms 1. Triangular Arbitrage (Please round to four decimal places) Suppose you observe the following posted exchange rates on the Japanese yen ) and

bl ms 1. Triangular Arbitrage (Please round to four decimal places) Suppose you observe the following posted exchange rates on the Japanese yen ) and South African rand (R) against the US dollar: PY 97.3702/S ZAR R10.1453/S The posted cross rate between the yen and the rand is currently 19.00/R a. Calculate the correct cross rate and determine whether arbitrage opportunity exist. If so, specify which currency is overvalued or undervalued under the quoted cross rate, and describe how you would conduct the arbitrage. (15 pts) b. Explain the realignment process and how are the spot rates (/S) and (R/S), and cross rate (/R) affected. (15 pts). c. Calculate your arbitrage profits. (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts