Question: Blackjack Inc. wants to replace a 9-year-old machine with a new machine that is more efficient. The old machine cost $70,000 when new and has

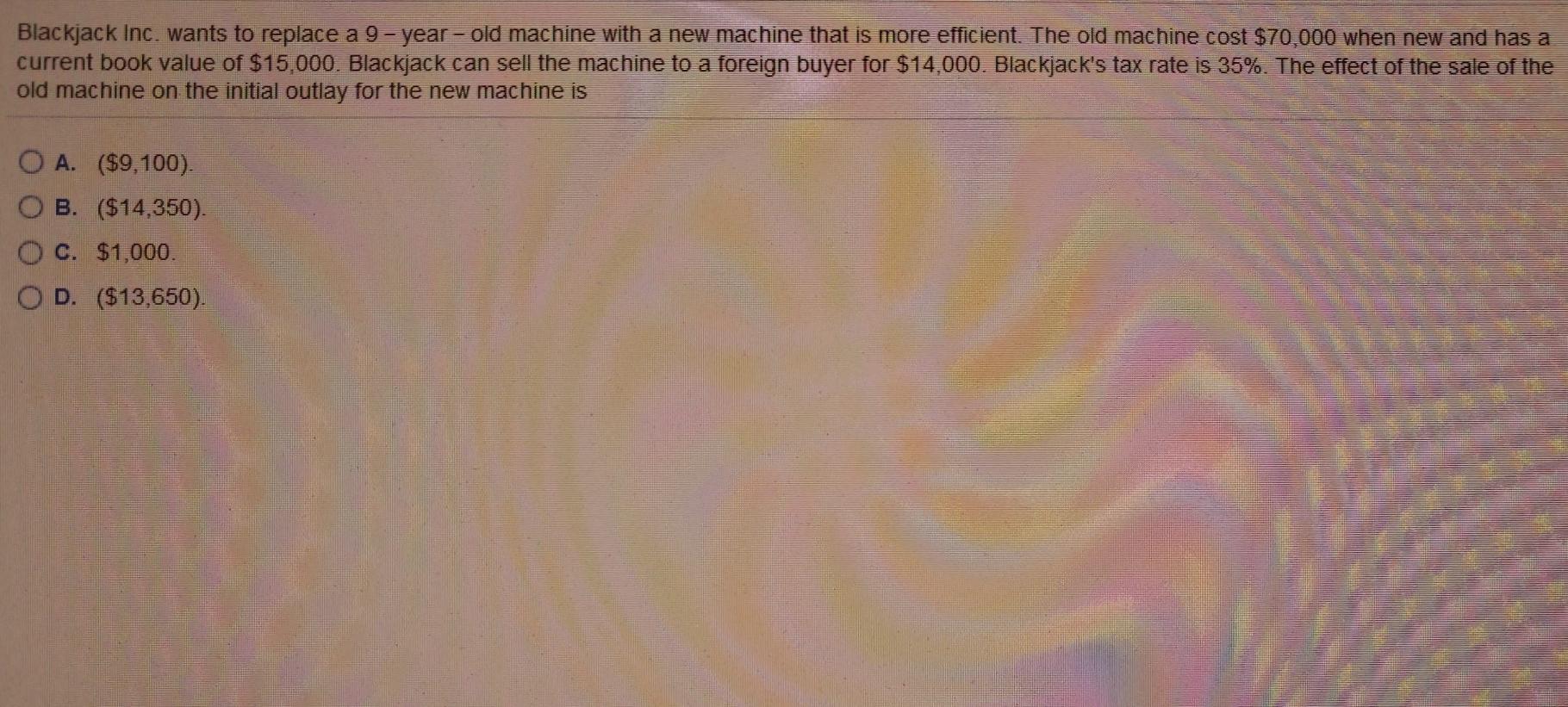

Blackjack Inc. wants to replace a 9-year-old machine with a new machine that is more efficient. The old machine cost $70,000 when new and has a current book value of $15,000. Blackjack can sell the machine to a foreign buyer for $14,000. Blackjack's tax rate is 35%. The effect of the sale of the old machine on the initial outlay for the new machine is O A. ($9,100). B. ($14,350). O C. $1,000. OD. ($13,650)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts