Question: Blaine Kitchenware Case: Should Dubinski recommend a large share repurchase to Blaines board? What are the primary advantages and disadvantages of such move? As a

Blaine Kitchenware Case:

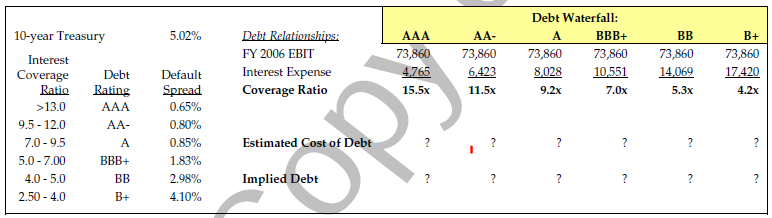

- Should Dubinski recommend a large share repurchase to Blaines board? What are the primary advantages and disadvantages of such move? As a member of Blaines controlling family, would you be in favor of this proposal? Would you be in favor of it as a non-family shareholder? How does the proposal sketched above differ from a special dividend of $4.39 per share? Suppose that Mr. Dubinski has obtained from Blaines banker the quotes bellow for default spread over last 10-year Treasury bonds (note that these differ from the more general corporate bond yield in the case Exhibit 4.) what do these quotes imply about BKI cost of debt at the various debt level and credit ratings? Compute BKIs weighted average cost of capital for each of the indicated debt levels. What do your calculation imply about optimal capital structure? Based on these calculations, how may shares should Blaine purchase and at what price?

5.02% Debt Relationships: FY 2006 EBIT Interest Expense Coverage Ratio AAA 73,860 4,765 15.5x AA- 73,860 6,423 11.5x Debt Waterfall: A BBB+ 73,860 73,860 8,028 10,551 9.2x 7.Ox BB 73,860 14,069 5.3x B+ 73,860 17,420 4.2x 10-year Treasury Interest Coverage Debt Ratio Rating >13.0 AAA 9.5 - 12.0 AA- 7.0 - 9.5 A 5.0 -7.00 BBB+ 4.0 - 5.0 BB 2.50 -4.0 B+ a Default Spread 0.65% 0.80% 0.85% 1.83% 2.98% 4.10% Estimated Cost of Debt ? ? ? ? ? ? Implied Debt ? ? ? ? ? ? 5.02% Debt Relationships: FY 2006 EBIT Interest Expense Coverage Ratio AAA 73,860 4,765 15.5x AA- 73,860 6,423 11.5x Debt Waterfall: A BBB+ 73,860 73,860 8,028 10,551 9.2x 7.Ox BB 73,860 14,069 5.3x B+ 73,860 17,420 4.2x 10-year Treasury Interest Coverage Debt Ratio Rating >13.0 AAA 9.5 - 12.0 AA- 7.0 - 9.5 A 5.0 -7.00 BBB+ 4.0 - 5.0 BB 2.50 -4.0 B+ a Default Spread 0.65% 0.80% 0.85% 1.83% 2.98% 4.10% Estimated Cost of Debt ? ? ? ? ? ? Implied Debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts