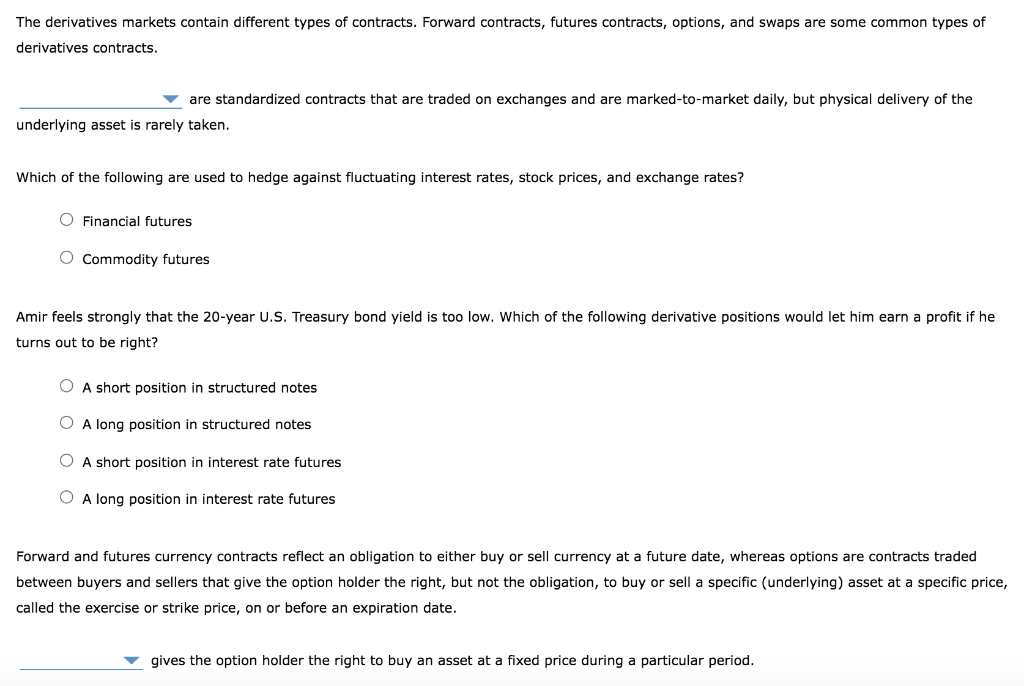

Question: Blank 1- Forward Contacts / Future Contacts Blank 2- A put option / A call Option The derivatives markets contain different types of contracts. Forward

Blank 1- Forward Contacts / Future Contacts

Blank 2- A put option / A call Option

The derivatives markets contain different types of contracts. Forward contracts, futures contracts, options, and swaps are some common types of derivatives contracts. are standardized contracts that are traded on exchanges and are marked-to-market daily, but physical delivery of the underlying asset is rarely taken. Which of the following are used to hedge against fluctuating interest rates, stock prices, and exchange rates? O Financial futures O Commodity futures Amir feels strongly that the 20-year U.S. Treasury bond yield is too low. Which of the following derivative positions would let him earn a profit if he turns out to be right? O A short position in structured notes O A long position in structured notes O A short position in interest futures O A long position in interest rate futures Forward and futures currency contracts reflect an obligation to either buy or sell currency at a future date, whereas options are contracts traded between buyers and sellers that give the option holder the right, but not the obligation, to buy or sell a specific (underlying) asset at a specific price, called the exercise or strike price, on or before an expiration date. gives the option holder the right to buy an asset at a fixed price during a particular period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts