Question: blank 1- giving up or using blank 2- more or less blank 3- should not or should Companies often need to choose between making an

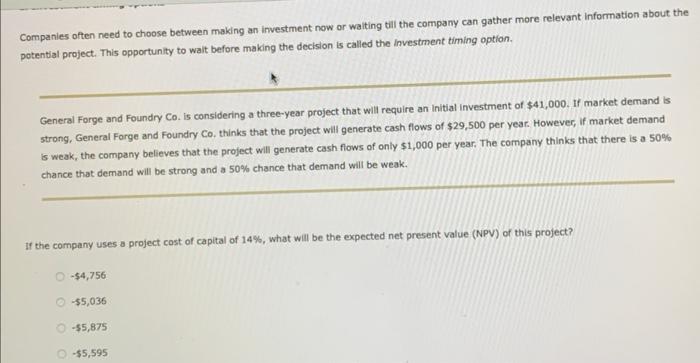

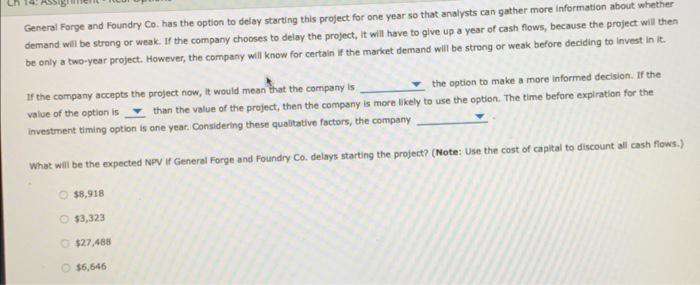

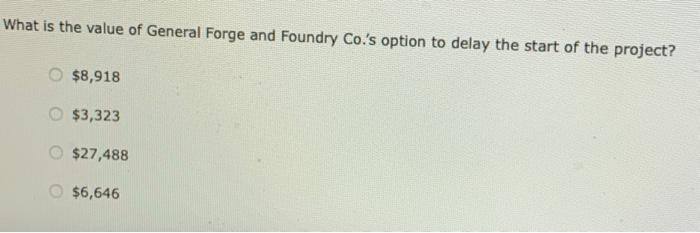

Companies often need to choose between making an investment now or waiting till the company can gather more relevant information about the potential project. This opportunity to wait before making the decision is called the investment timing option. General Forge and Foundry Co. is considering a three-year project that will require an Initial investment of $41,000. If market demand is strong, General Forge and Foundry Co, thinks that the project will generate cash flows of $29,500 per year. However, If market demand is weak, the company believes that the project will generate cash flows of only $1,000 per year. The company thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 14%, what will be the expected net present value (NPV) of this project? $4,756$5,036$5,875$5,595 General Forge and Foundry Co. has the option to delay starting this project for one year so that analysts can gather more information about whether demand will be strong or weak. If the company chooses to delay the project, it will have to give up a year of cash flows, because the project will then be only a two-year project. However, the company will know for certain if the market demand will be strong or weak before deciding to invest in it. If the company accepts the project now, lit would mean that the company is the option to make a more informed decision. If the value of the option is than the value of the project, then the company is more likely to use the option. The time befare expiration for the investment timing option is one year. Considering these qualitative factors, the company What will be the expected NpN If General Forge and Foundry Co. delays starting the project? (Note: Use the cost of capltal to discount all cash flows.) $8,918 53,323 $27,488 $6,646 What is the value of General Forge and Foundry Co.'s option to delay the start of the project? $8,918 $3,323 $27,488 $6,646

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts