Question: BLANK Options for each: 1. for both % 6 7 8 9 2. The future value of your initial investment after three years is BLANK

BLANK Options for each:

1. for both %

6

7

8

9

2. The future value of your initial investment after three years is BLANK OPTIONS

991

1091

1191

1291

1391

3. Now, suppose you also the option to buy a 3-yr bond with a 7.5% yield to maturity for $1000. The future value of the investment is BLANK OPTIONS

1242

1342

1442

1542

4. Suppose the liquidity premium theory holds. The liquidity premium for the 3-yr bond is BLANK OPTIONS

-0.5

0.0

1.5

2.0

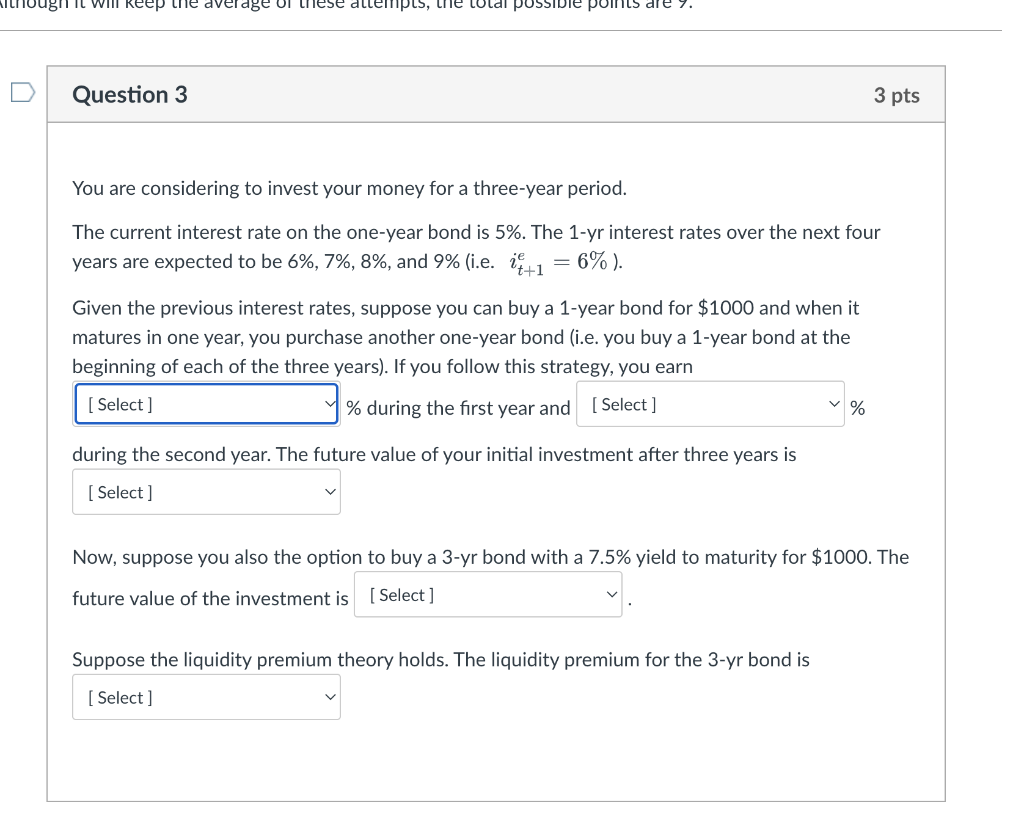

You are considering to invest your money for a three-year period. The current interest rate on the one-year bond is 5%. The 1-yr interest rates over the next four years are expected to be 6%,7%,8%, and 9% (i.e. it+1e=6% ). Given the previous interest rates, suppose you can buy a 1-year bond for $1000 and when it matures in one year, you purchase another one-year bond (i.e. you buy a 1-year bond at the beginning of each of the three years). If you follow this strategy, you earn % during the first year and % during the second year. The future value of your initial investment after three years is Now, suppose you also the option to buy a 3-yr bond with a 7.5% yield to maturity for $1000. The future value of the investment is Suppose the liquidity premium theory holds. The liquidity premium for the 3-yr bond is You are considering to invest your money for a three-year period. The current interest rate on the one-year bond is 5%. The 1-yr interest rates over the next four years are expected to be 6%,7%,8%, and 9% (i.e. it+1e=6% ). Given the previous interest rates, suppose you can buy a 1-year bond for $1000 and when it matures in one year, you purchase another one-year bond (i.e. you buy a 1-year bond at the beginning of each of the three years). If you follow this strategy, you earn % during the first year and % during the second year. The future value of your initial investment after three years is Now, suppose you also the option to buy a 3-yr bond with a 7.5% yield to maturity for $1000. The future value of the investment is Suppose the liquidity premium theory holds. The liquidity premium for the 3-yr bond is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts