Question: . Blasting Rock Inc. is considering whether to spend $5 million on new equipment it would install in an empty building that it acquired for

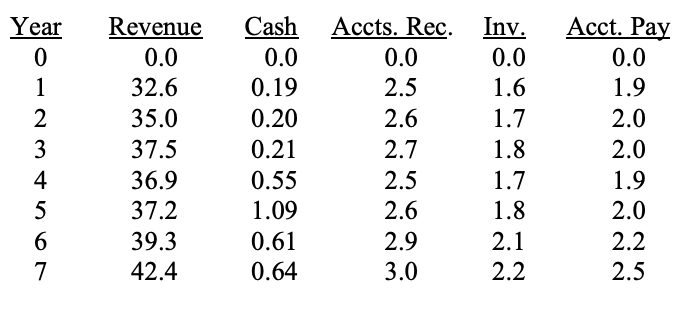

. Blasting Rock Inc. is considering whether to spend $5 million on new equipment it would install in an empty building that it acquired for $30 million ten years ago. The building has been being depreciated on a straightline basis to zero over a 30-year horizon and has already been depreciated this year. The building would otherwise be sold as is for $20 million after taxes today. The cost of the new equipment would be depreciated starting a year from today according to the 15-year MACRS class. Variable costs associated with acquiring the equipment would equal 55% of revenues and fixed costs associated with the new equipment would $10 million per year starting a year from today. The firms marginal tax rate equals 21%. Using this information and the information in the table below (all millions) set up the calculations needed to determine the free cash flow associated with the new equipment for today and three years from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts