Question: Bloopers analysts have come up with the following revised estimates for its magnoosium mine: Range Pessimistic Optimistic Initial investment + 25 % 15 % Revenues

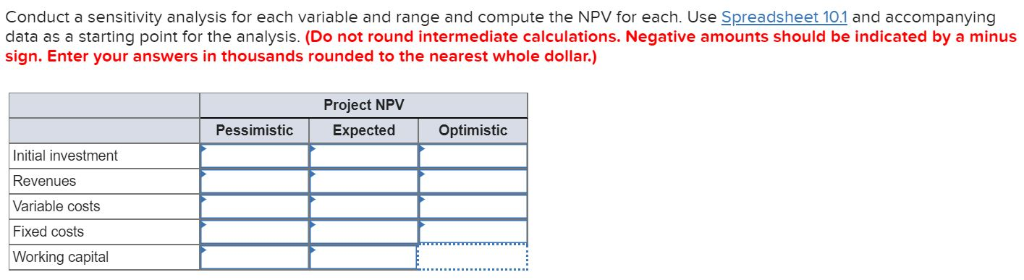

Bloopers analysts have come up with the following revised estimates for its magnoosium mine: Range Pessimistic Optimistic Initial investment + 25 % 15 % Revenues 20 % + 15 % Variable costs + 20 % 25 % Fixed cost + 45 % 30 % Working capital + 40 % 45 % Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.)

Bloopers analysts have come up with the following revised estimates for its magnoosium mine: Range Pessimistic Optimistic Initial investment + 25 % 15 % Revenues 20 % + 15 % Variable costs + 20 % 25 % Fixed cost + 45 % 30 % Working capital + 40 % 45 % Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.)

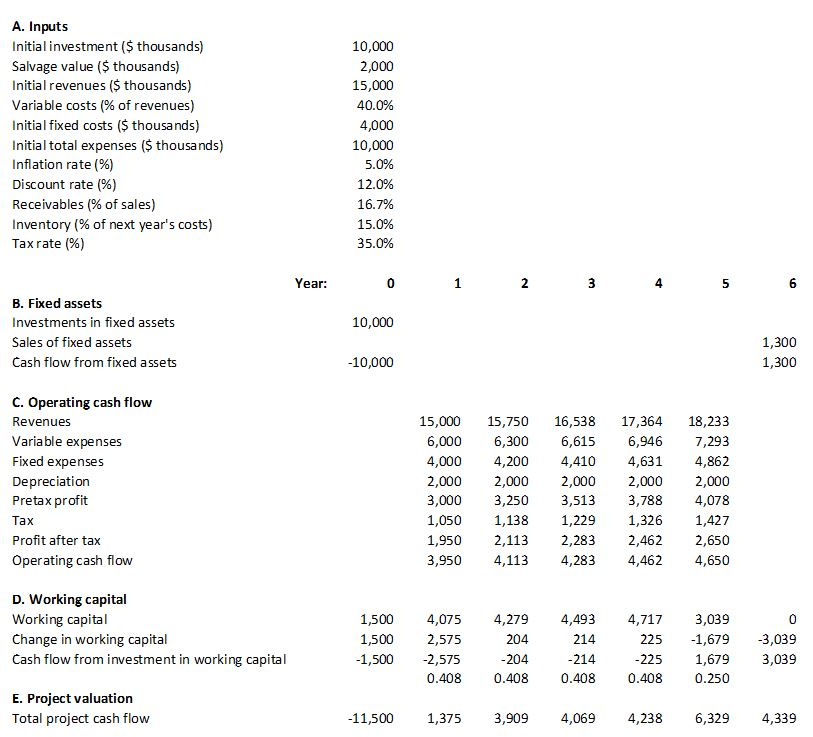

Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.) Project NPV Expected Pessimistic Optimistic Initial investment Revenues Variable costs Fixed costs Working capital A. Inputs Initial investment ($ thousands) Salvage value ($ thousands) Initial revenues ($ thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Initial total expenses ($ thousands) Inflation rate (%) Discount rate (%) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (%) 10,000 2,000 15,000 40.0% 4,000 10,000 5.0% 12.0% 16.7% 15.0% 35.0% Year: 10,000 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 1,300 1,300 -10,000 C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 15,000 6,000 4,000 2,000 3,000 1,050 1,950 3,950 15,750 6,300 4,200 2,000 3,250 1,138 2,113 4,113 16,538 6,615 4,410 2,000 3,513 1,229 2,283 4,283 17,364 6,946 4,631 2,000 3,788 1,326 2,462 4,462 18,233 7,293 4,862 2,000 4,078 1,427 2,650 4,650 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 1,500 1,500 -1,500 4,075 2,575 -2,575 0.408 4,279 204 -204 0.408 4,493 214 -214 0.408 4,717 225 -225 0.408 3,039 -1,679 1,679 0.250 -3,039 3,039 E. Project valuation Total project cash flow -11,500 1,375 3,909 4,069 4,238 6,3294,339 Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole dollar.) Project NPV Expected Pessimistic Optimistic Initial investment Revenues Variable costs Fixed costs Working capital A. Inputs Initial investment ($ thousands) Salvage value ($ thousands) Initial revenues ($ thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Initial total expenses ($ thousands) Inflation rate (%) Discount rate (%) Receivables (% of sales) Inventory (% of next year's costs) Tax rate (%) 10,000 2,000 15,000 40.0% 4,000 10,000 5.0% 12.0% 16.7% 15.0% 35.0% Year: 10,000 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 1,300 1,300 -10,000 C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 15,000 6,000 4,000 2,000 3,000 1,050 1,950 3,950 15,750 6,300 4,200 2,000 3,250 1,138 2,113 4,113 16,538 6,615 4,410 2,000 3,513 1,229 2,283 4,283 17,364 6,946 4,631 2,000 3,788 1,326 2,462 4,462 18,233 7,293 4,862 2,000 4,078 1,427 2,650 4,650 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 1,500 1,500 -1,500 4,075 2,575 -2,575 0.408 4,279 204 -204 0.408 4,493 214 -214 0.408 4,717 225 -225 0.408 3,039 -1,679 1,679 0.250 -3,039 3,039 E. Project valuation Total project cash flow -11,500 1,375 3,909 4,069 4,238 6,3294,339

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts