Question: Blossom Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The

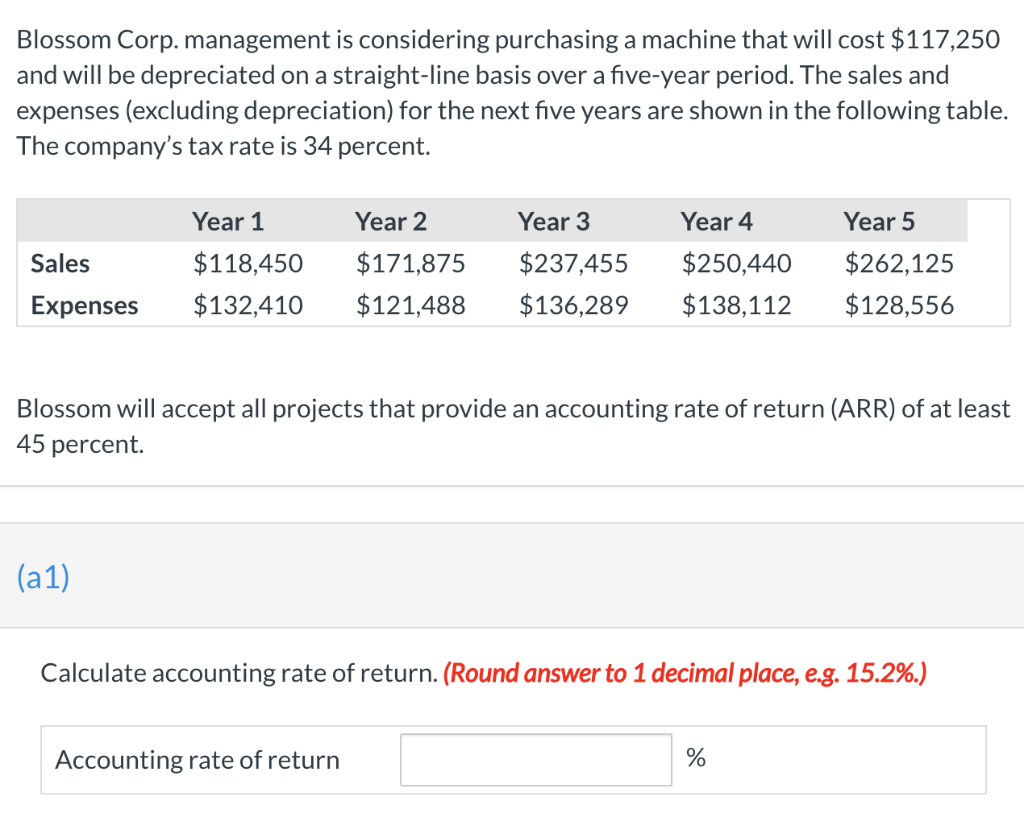

Blossom Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company's tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $118,450 $132,410 $171,875 $121,488 $237,455 $136,289 $250,440 $138,112 $262,125 $128,556 Expenses Blossom will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts