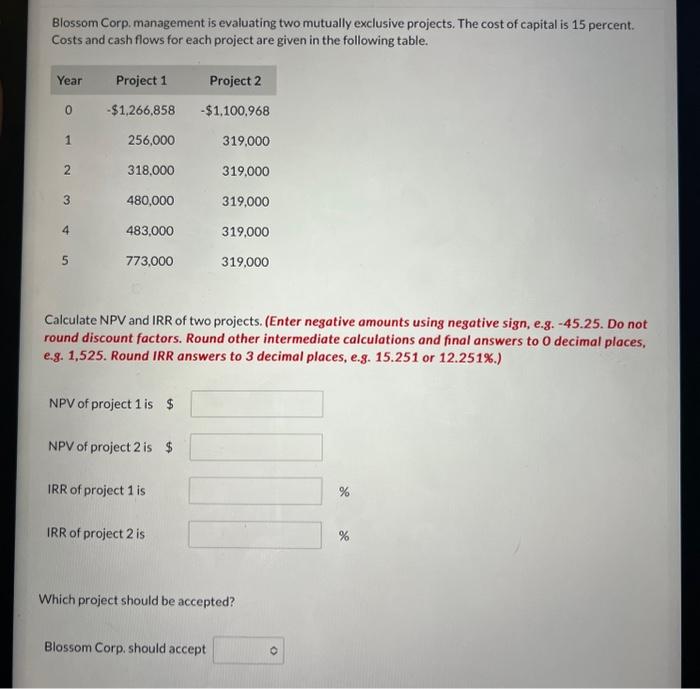

Question: Blossom Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project are given

Blossom Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project are given in the following table. Calculate NPV and IRR of two projects. (Enter negative amounts using negative sign, e.g. -45.25 . Do not round discount factors. Round other intermediate calculations and final answers to 0 decimal places, e.g. 1,525. Round IRR answers to 3 decimal places, e.g. 15.251 or 12.251\%.) NPV of project 1 is $ NPV of project 2 is $ IRR of project 1 is IRR of project 2 is % % Which project should be accepted? Blossom Corp. should accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts