Question: Blue Eagle Food is considering a project that would last for 3 years and have a cost of capital of 18.42 percent. The relevant level

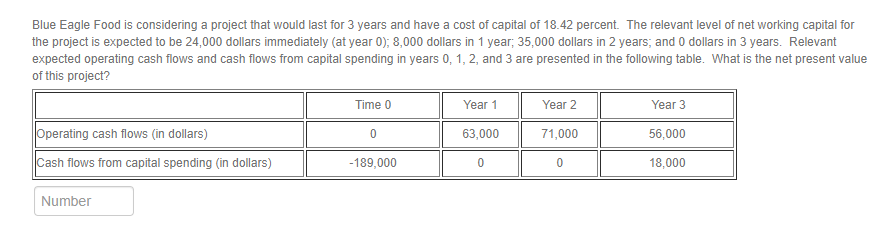

Blue Eagle Food is considering a project that would last for 3 years and have a cost of capital of 18.42 percent. The relevant level of net working capital for the project is expected to be 24,000 dollars immediately (at year 0); 8,000 dollars in 1 year; 35,000 dollars in 2 years; and 0 dollars in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project?

Blue Eagle Food is considering a project that would last for 3 years and have a cost of capital of 18.42 percent. The relevant level of net working capital for the project is expected to be 24,000 dollars immediately (at year 0); 8,000 dollars in 1 year; 35,000 dollars in 2 years; and 0 dollars in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project?

Blue Eagle Food is considering a project that would last for 3 years and have a cost of capital of 18.42 percent. The relevant level of net working capital for the project is expected to be 24,000 dollars immediately (at year 0); 8,000 dollars in 1 year; 35,000 dollars in 2 years; and 0 dollars in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project?

Blue Eagle Food is considering a project that would last for 3 years and have a cost of capital of 18.42 percent. The relevant level of net working capital for the project is expected to be 24,000 dollars immediately (at year 0); 8,000 dollars in 1 year, 35,000 dollars in 2 years, and 0 dollars in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project? Time 0 Year 1 Year 2 Year 3 Operating cash flows (in dollars) 63,000 71,000 56,000 Cash flows from capital spending (in dollars) - 189,000 0 18,000 0 0 Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts