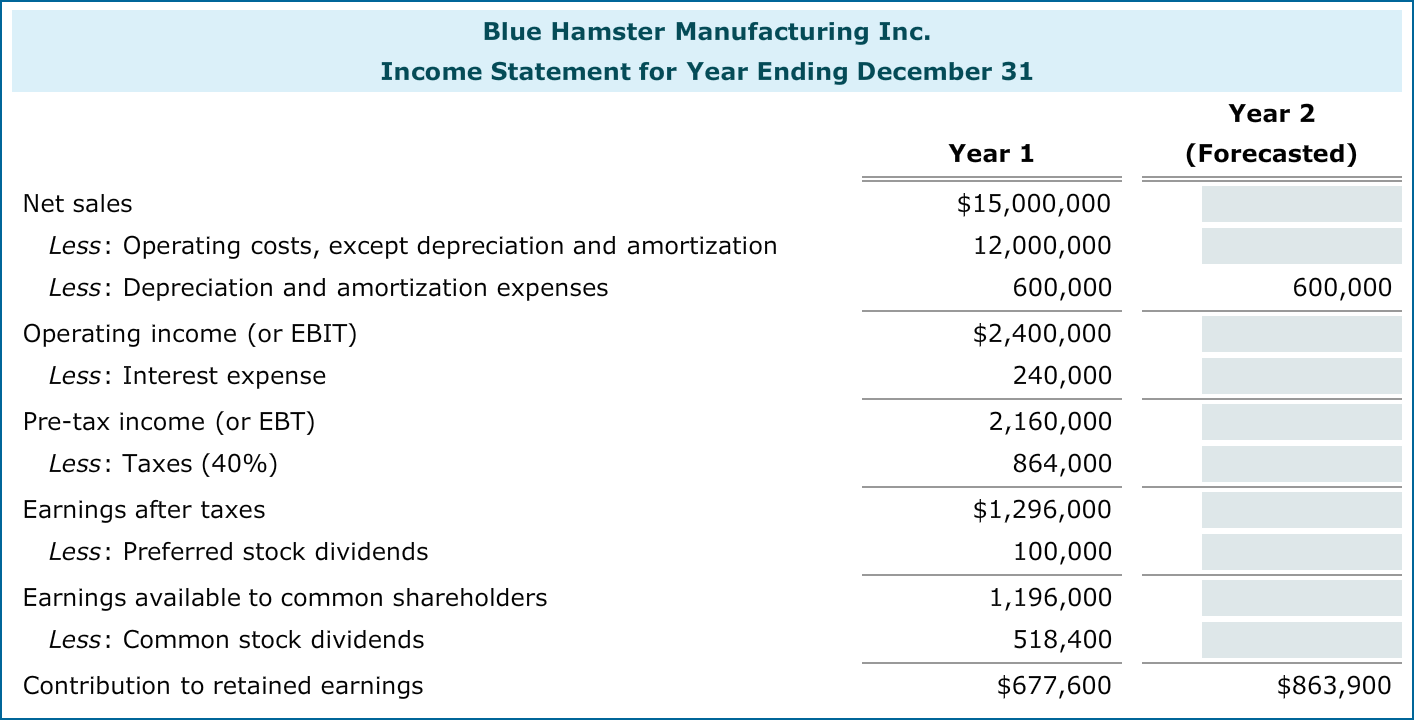

Question: Blue Hamster Manufacturing Inc.?s income statement reports data for its first year of operation. The firm?s CEO would like sales to increase by 25v/o next

Blue Hamster Manufacturing Inc.?s income statement reports data for its first year of operation. The firm?s CEO would like sales to increase by 25v/o next year. 1. Blue Hamster is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company?s operating costs (excluding depreciation and amortization) remain at 80% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company?s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Blue Hamster expects to pay $100,000 and $642,600 of preferred and common stock dividends, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts