Question: Blue Mountain Mining paid $ 5 8 2 , 8 0 0 for the right to extract mineral assets from a 4 5 0 ,

Blue Mountain Mining paid $ for the right to extract mineral assets from a ton deposit. In addition to the purchase price, Blue also paid a $ filing fies, a $ Icense fee to the state of Nevada, and $ for a geological survey of the property. Because Blue purchased the rights to the minerals only and did not purchase the land, it expects the asset to have zero residual value. During the frst year, Blue removed and sold tons of the minerals. Make journal entries to record a purchase of the minerals debit Mineralsb payment of fees and other costs, and c depletion for the first year. Recond debits first, then credis. Select the explanation on the liset line of the journal entry table.

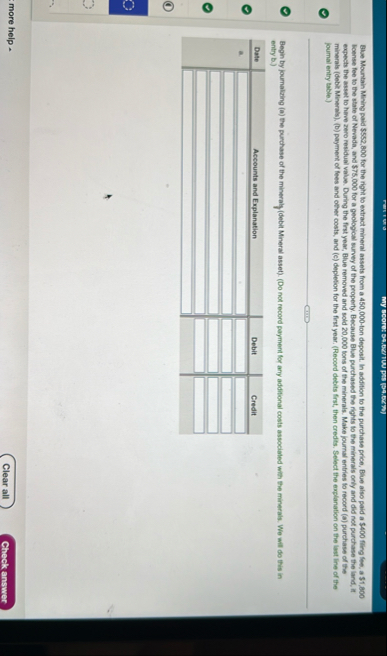

Begin by journalzing a the purchase of the mineraly debit Mineral assetDo not recond payment for any additional costs associated with the minerals. We will do this in entry b

tableDateAccounts and Explanation,Debit,Credita

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock