Question: Blueprint Problem: Operating assets and declining balance method of depreciation (corp) Nature and Measurement of Operating Assets A noncurrent asset that is used in

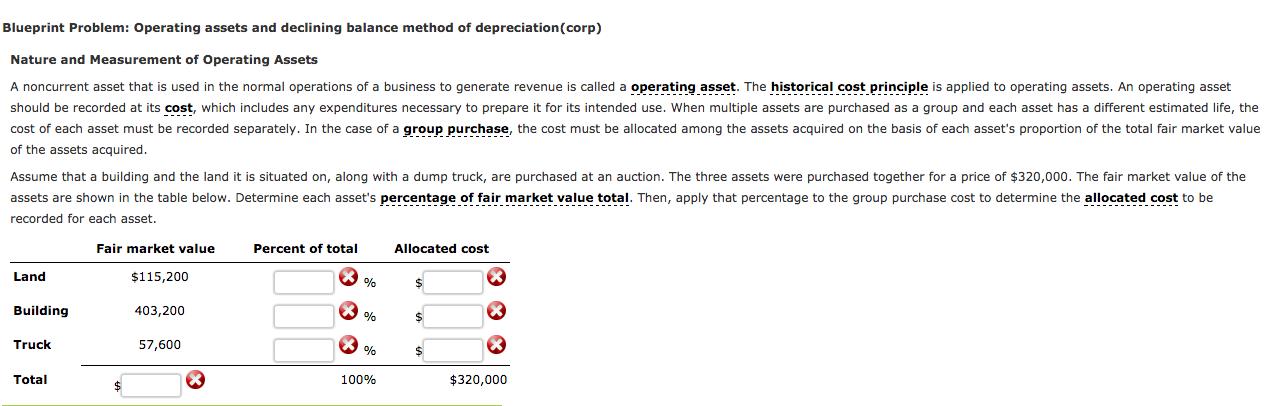

Blueprint Problem: Operating assets and declining balance method of depreciation (corp) Nature and Measurement of Operating Assets A noncurrent asset that is used in the normal operations of a business to generate revenue is called a operating asset. The historical cost principle is applied to operating assets. An operating asset should be recorded at its cost, which includes any expenditures necessary to prepare it for its intended use. When multiple assets are purchased as a group and each asset has a different estimated life, the cost of each asset must be recorded separately. In the case of a group purchase, the cost must be allocated among the assets acquired on the basis of each asset's proportion of the total fair market value of the assets acquired. Assume that a building and the land it is situated on, along with a dump truck, are purchased at an auction. The three assets were purchased together for a price of $320,000. The fair market value of the assets are shown in the table below. Determine each asset's percentage of fair market value total. Then, apply that percentage to the group purchase cost to determine the allocated cost to be recorded for each asset. Land Building Truck Total Fair market value $115,200 403,200 57,600 Allocated cost X % $ E X % $ X % 100% Percent of total X $320,000

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

1 i 1 I OHN MA 3 4 Solution B Land Building Truck To... View full answer

Get step-by-step solutions from verified subject matter experts