Question: BMGT 301 Excel Project 3 Spring 2022 Case Info: Karake, Inc., the manufacturer of the ErgoBeds product line, is planning to bring to market a

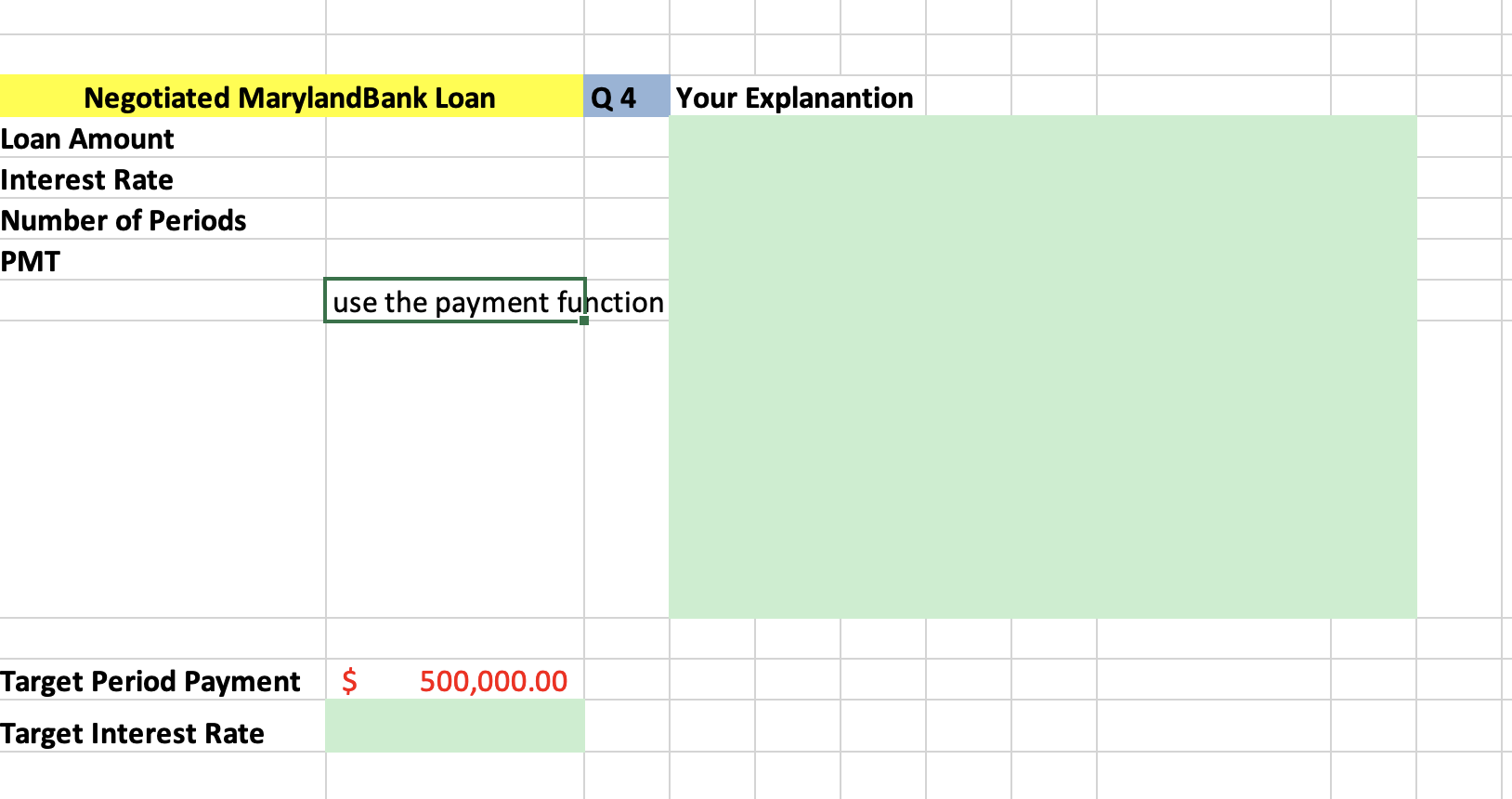

BMGT 301 Excel Project 3 Spring 2022 Case Info: Karake, Inc., the manufacturer of the ErgoBeds product line, is planning to bring to market a new line of products called ErgoChairs. Kevin Ayyeni, the company's financial analyst, needs to see if this is a worthwhile investment. Kevin estimated the project's initial capital outlay at $5 million, which will cover the cost of renovating a proposed manufacturing facility that will be rented, and the cost of new machinery to produce the new product line. Kevin has listed the projected returns over the next 15 years and assumed a discount rate of 6%. The expected annual cash inflows from the project can be found on the ErgoChair Evaluation sheet of the Excel file. One critical element that is left to be analyzed is the funding required to produce the ErgoChairs. Before making a final decision to go with the project, Mr. Kevin Ayyeni must evaluate various alternatives to determine the most economically feasible way to finance the capital investment. Zach Sertac, the VP of Finance, was tasked with the job of exploring several funding scenarios and generating cash flow projections to be provided to management before a final decision is made. Refer to Question 4 sheet to complete question 4. 4. Assume you decided to go with the loan from Maryland Bank but you cannot afford to pay more than $500,000 per period (annually). You are willing to negotiate the interest rate with the bank, though. How much should you ask the bank to charge in interest in order to make sure that your periodic payment will be $500,000? Assume payments are still made annually for the next 15 years. Make sure to explain how you arrive at your answer in cell D4 and if it makes sense relative to your original answer. Additionally, record your target interest rate in cell B12 to 2 significant places. (1.5 Points). Based on Zach's analysis of several financing options for the ErgoChairs Line, he decided to recommend the following option to finance the initial capital outlays for this project: "Fund the project by borrowing the money from Maryland Bank. The bank currently charges an interest rate (APR) of 6 percent compounded annually and requires the payments to be made over the next 15 years. Given that Karake, Inc. has been doing business with Maryland Bank for the past 20 years I am confident the loan will be approved." Negotiated MarylandBank Loan Q4 Your Explanantion Loan Amount Interest Rate Number of Periods PMT use the payment function Target Period Payment $ 500,000.00 Target Interest Rate BMGT 301 Excel Project 3 Spring 2022 Case Info: Karake, Inc., the manufacturer of the ErgoBeds product line, is planning to bring to market a new line of products called ErgoChairs. Kevin Ayyeni, the company's financial analyst, needs to see if this is a worthwhile investment. Kevin estimated the project's initial capital outlay at $5 million, which will cover the cost of renovating a proposed manufacturing facility that will be rented, and the cost of new machinery to produce the new product line. Kevin has listed the projected returns over the next 15 years and assumed a discount rate of 6%. The expected annual cash inflows from the project can be found on the ErgoChair Evaluation sheet of the Excel file. One critical element that is left to be analyzed is the funding required to produce the ErgoChairs. Before making a final decision to go with the project, Mr. Kevin Ayyeni must evaluate various alternatives to determine the most economically feasible way to finance the capital investment. Zach Sertac, the VP of Finance, was tasked with the job of exploring several funding scenarios and generating cash flow projections to be provided to management before a final decision is made. Refer to Question 4 sheet to complete question 4. 4. Assume you decided to go with the loan from Maryland Bank but you cannot afford to pay more than $500,000 per period (annually). You are willing to negotiate the interest rate with the bank, though. How much should you ask the bank to charge in interest in order to make sure that your periodic payment will be $500,000? Assume payments are still made annually for the next 15 years. Make sure to explain how you arrive at your answer in cell D4 and if it makes sense relative to your original answer. Additionally, record your target interest rate in cell B12 to 2 significant places. (1.5 Points). Based on Zach's analysis of several financing options for the ErgoChairs Line, he decided to recommend the following option to finance the initial capital outlays for this project: "Fund the project by borrowing the money from Maryland Bank. The bank currently charges an interest rate (APR) of 6 percent compounded annually and requires the payments to be made over the next 15 years. Given that Karake, Inc. has been doing business with Maryland Bank for the past 20 years I am confident the loan will be approved." Negotiated MarylandBank Loan Q4 Your Explanantion Loan Amount Interest Rate Number of Periods PMT use the payment function Target Period Payment $ 500,000.00 Target Interest Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts