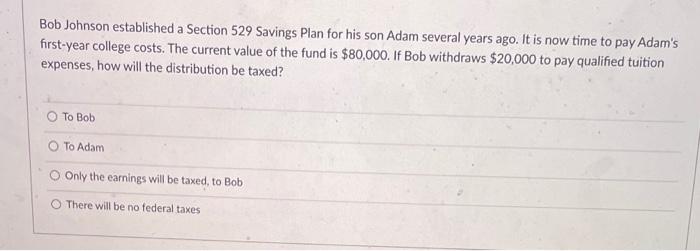

Question: Bob Johnson established a Section 529 Savings Plan for his son Adam several years ago. It is now time to pay Adam's first-year college costs.

Bob Johnson established a Section 529 Savings Plan for his son Adam several years ago. It is now time to pay Adam's first-year college costs. The current value of the fund is $80,000. If Bob withdraws $20,000 to pay qualified tuition expenses, how will the distribution be taxed? To Bob To Adam Only the earnings will be taxed, to Bob There will be no federal taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts