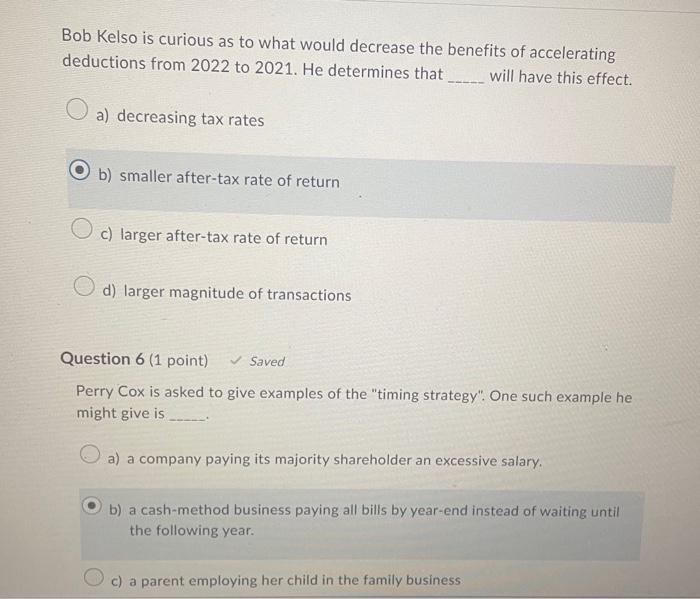

Question: Bob Kelso is curious as to what would decrease the benefits of accelerating deductions from 2022 to 2021 . He determines that will have this

Bob Kelso is curious as to what would decrease the benefits of accelerating deductions from 2022 to 2021 . He determines that will have this effect. a) decreasing tax rates b) smaller after-tax rate of return c) larger after-tax rate of return d) larger magnitude of transactions Question 6(1 point) Saved Perry Cox is asked to give examples of the "timing strategy". One such example he might give is a) a company paying its majority shareholder an excessive salary. b) a cash-method business paying all bills by year-end instead of waiting until the following year. c) a parent employing her child in the family business Bob Kelso is curious as to what would decrease the benefits of accelerating deductions from 2022 to 2021 . He determines that will have this effect. a) decreasing tax rates b) smaller after-tax rate of return c) larger after-tax rate of return d) larger magnitude of transactions Question 6(1 point) Saved Perry Cox is asked to give examples of the "timing strategy". One such example he might give is a) a company paying its majority shareholder an excessive salary. b) a cash-method business paying all bills by year-end instead of waiting until the following year. c) a parent employing her child in the family business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts