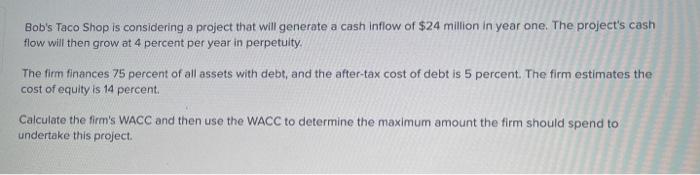

Question: Bob's Taco Shop is considering a project that will generate a cash inflow of $24 million in year one. The project's cash flow will then

Bob's Taco Shop is considering a project that will generate a cash inflow of $24 million in year one. The project's cash flow will then grow at 4 percent per year in perpetuity The firm finances 75 percent of all assets with debt, and the after-tax cost of debt is 5 percent. The firm estimates the cost of equity is 14 percent. Calculate the firm's WACC and then use the WACC to determine the maximum amount the firm should spend to undertake this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts