Question: Bock_11.pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Bcok_11 ad x Chapter 3 pdf Sign In 37 1116

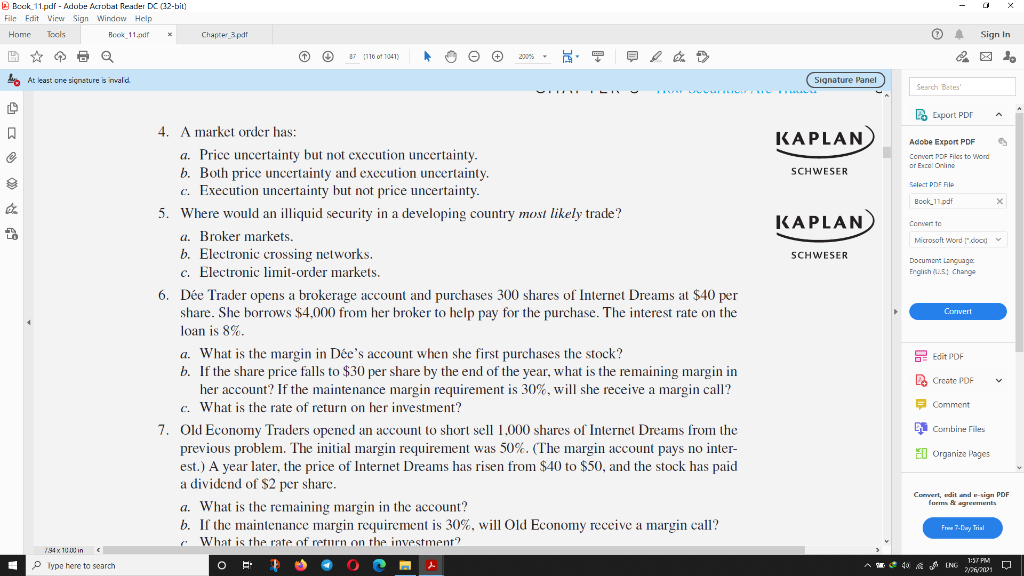

Bock_11.pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Bcok_11 ad x Chapter 3 pdf Sign In 37 1116 of 1041) 2005 At least one signature is invalid Signature Panel Search Bates Export PDF A KAPLAN Adobe Export PDF Convert PDF Files to Word or Excel Online SCHWESER Selet PDF File Bock, 11.pdf X KAPLAN Conwerto Microsoft Word (.doc SCHWESER Document Language English (US) Change Convert 4. A market order has: a. Price uncertainty but not execution uncertainty. b. Both price uncertainty and execution uncertainty. c. Execution uncertainty but not price uncertainty. 5. Where would an illiquid security in a developing country most likely trade? a. Broker markets. b. Electronic crossing networks. c. Electronic limit-order markets. 6. De Trader opens a brokerage account and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%. a. What is the margin in De's account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? If the maintenance margin requirement is 30%, will she receive a margin call? c. What is the rate of return on her investment? 7. Old Economy Traders opened an account to short sell 1.000 shares of Internet Dreams from the previous problem. The initial margin requirement was 50%. (The margin account pays no inter- est.) A year later, the price of Internet Dreams has risen from $40 to $50, and the stock has paid a dividend of $2 per share. a. What is the remaining margin in the account? b. If the maintenance margin requirement is 30%, will Old Economy receive a margin call? - What is the rate of return on the investment? Edit PDF D. Create PDF E Comment Combine Files El Organize Pages Convert dit and sign PDF forms & agrements Free 7-Day Trial 7.94 x 100 in Type here to search * 4ING 1:57 PM 2/21/2001 Bock_11.pdf - Adobe Acrobat Reader DC (32-bit) File Edit View Sign Window Help Home Tools Bcok_11 ad x Chapter 3 pdf Sign In 37 1116 of 1041) 2005 At least one signature is invalid Signature Panel Search Bates Export PDF A KAPLAN Adobe Export PDF Convert PDF Files to Word or Excel Online SCHWESER Selet PDF File Bock, 11.pdf X KAPLAN Conwerto Microsoft Word (.doc SCHWESER Document Language English (US) Change Convert 4. A market order has: a. Price uncertainty but not execution uncertainty. b. Both price uncertainty and execution uncertainty. c. Execution uncertainty but not price uncertainty. 5. Where would an illiquid security in a developing country most likely trade? a. Broker markets. b. Electronic crossing networks. c. Electronic limit-order markets. 6. De Trader opens a brokerage account and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%. a. What is the margin in De's account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? If the maintenance margin requirement is 30%, will she receive a margin call? c. What is the rate of return on her investment? 7. Old Economy Traders opened an account to short sell 1.000 shares of Internet Dreams from the previous problem. The initial margin requirement was 50%. (The margin account pays no inter- est.) A year later, the price of Internet Dreams has risen from $40 to $50, and the stock has paid a dividend of $2 per share. a. What is the remaining margin in the account? b. If the maintenance margin requirement is 30%, will Old Economy receive a margin call? - What is the rate of return on the investment? Edit PDF D. Create PDF E Comment Combine Files El Organize Pages Convert dit and sign PDF forms & agrements Free 7-Day Trial 7.94 x 100 in Type here to search * 4ING 1:57 PM 2/21/2001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts