Question: BOE Enterprises has 1 2 , 5 0 0 bonds outstanding that have a 7 % coupon rate and a $ 1 , 0 0

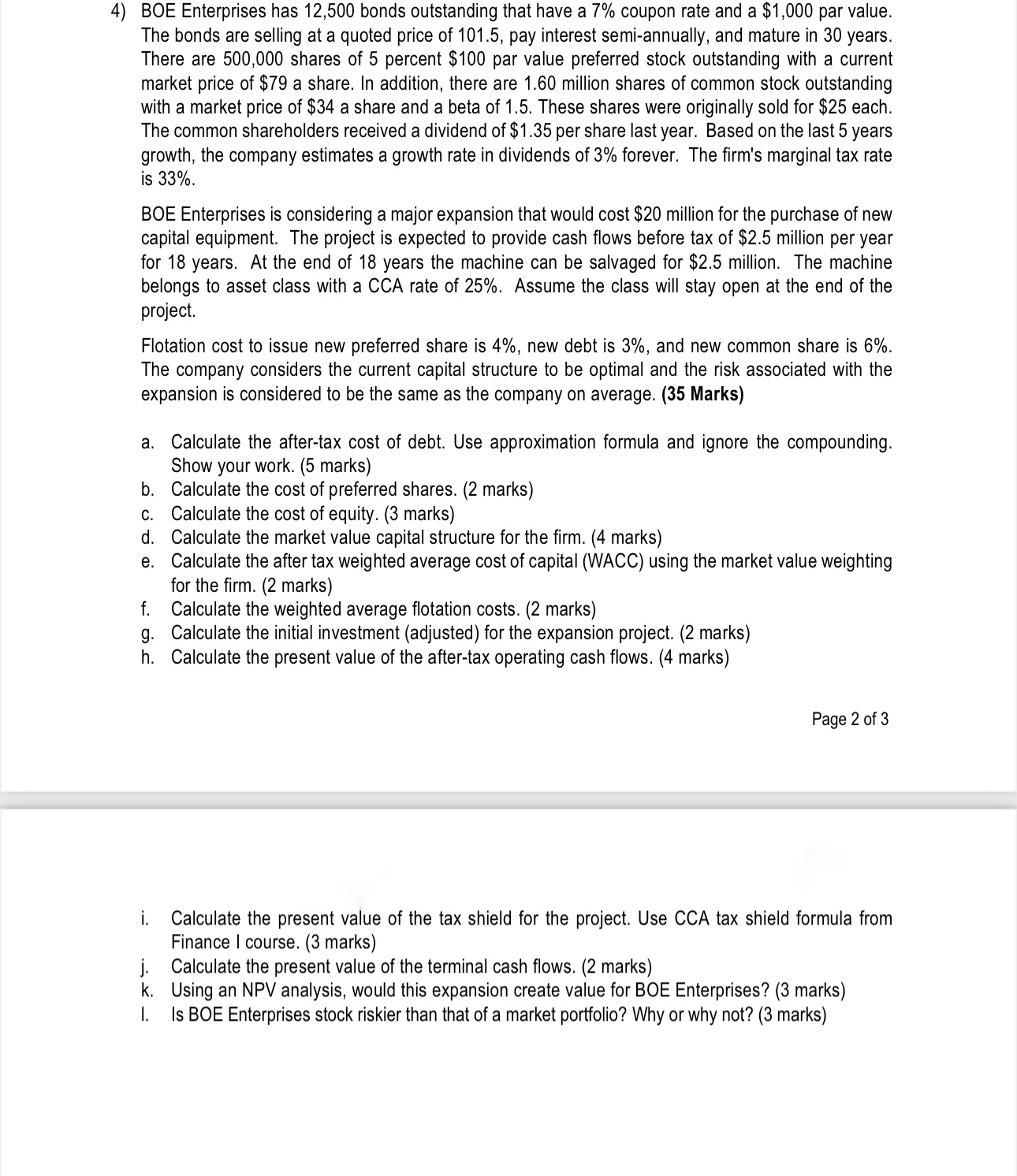

BOE Enterprises has bonds outstanding that have a coupon rate and a $ par value. The bonds are selling at a quoted price of pay interest semiannually, and mature in years. There are shares of percent $ par value preferred stock outstanding with a current market price of $ a share. In addition, there are million shares of common stock outstanding with a market price of $ a share and a beta of These shares were originally sold for $ each. The common shareholders received a dividend of $ per share last year. Based on the last years growth, the company estimates a growth rate in dividends of forever. The firm's marginal tax rate is

BOE Enterprises is considering a major expansion that would cost $ million for the purchase of new capital equipment. The project is expected to provide cash flows before tax of $ million per year for years. At the end of years the machine can be salvaged for $ million. The machine belongs to asset class with a CCA rate of Assume the class will stay open at the end of the project.

Flotation cost to issue new preferred share is new debt is and new common share is The company considers the current capital structure to be optimal and the risk associated with the expansion is considered to be the same as the company on average. Marks

a Calculate the aftertax cost of debt. Use approximation formula and ignore the compounding. Show your work. marks

b Calculate the cost of preferred shares. marks

c Calculate the cost of equity. marks

d Calculate the market value capital structure for the firm. marks

e Calculate the after tax weighted average cost of capital WACC using the market value weighting for the firm. marks

f Calculate the weighted average flotation costs. marks

g Calculate the initial investment adjusted for the expansion project. marks

h Calculate the present value of the aftertax operating cash flows. marks

Page of

i Calculate the present value of the tax shield for the project. Use CCA tax shield formula from Finance I course. marks

j Calculate the present value of the terminal cash flows. marks

k Using an NPV analysis, would this expansion create value for BOE Enterprises? marks

I. Is BOE Enterprises stock riskier than that of a market portfolio? Why or why not? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock