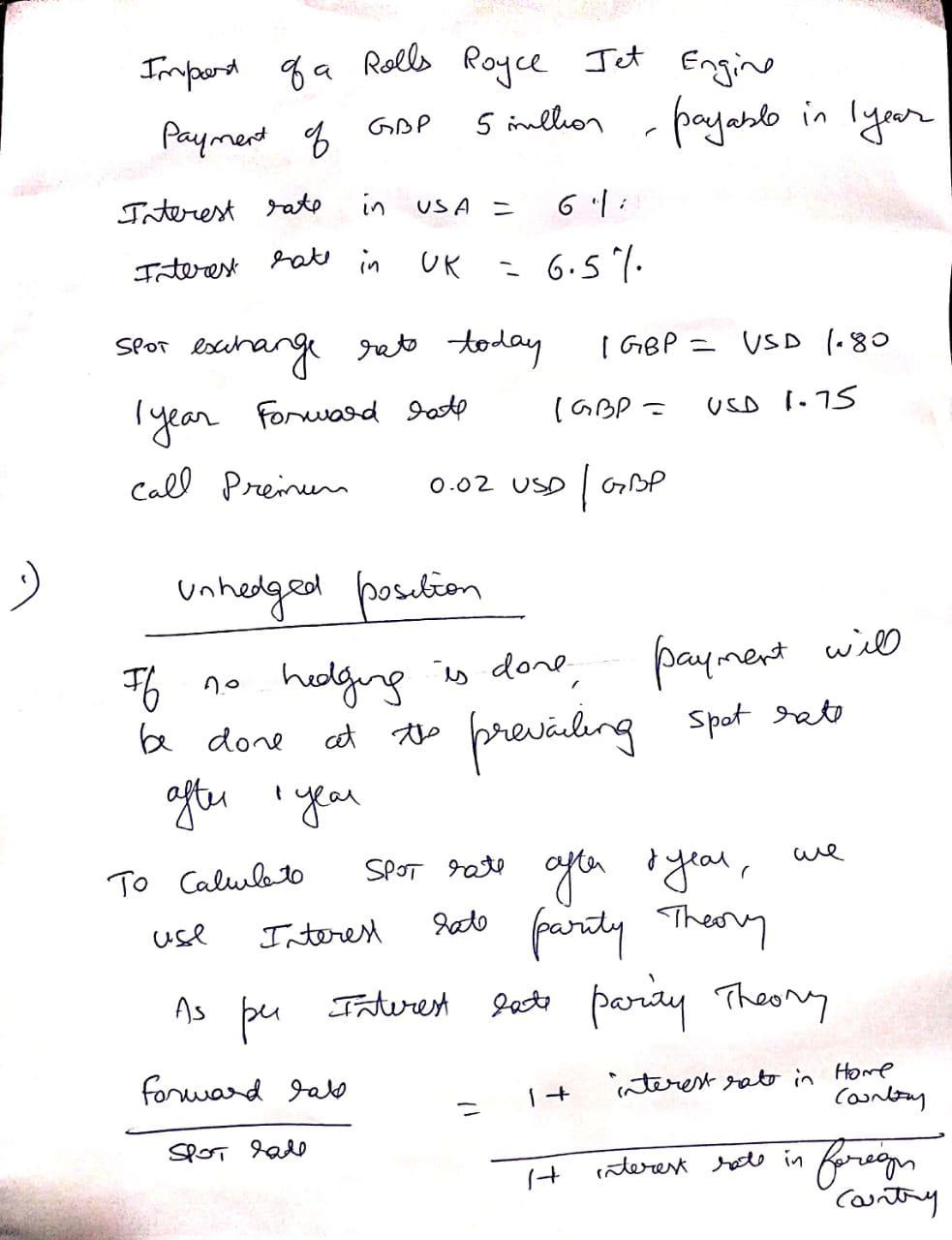

Question: Boeing imports a Rolls Royce jet engine. It will pay GPB 5 Million, payable in 1 year. The following information is given: RUS = 6.0%

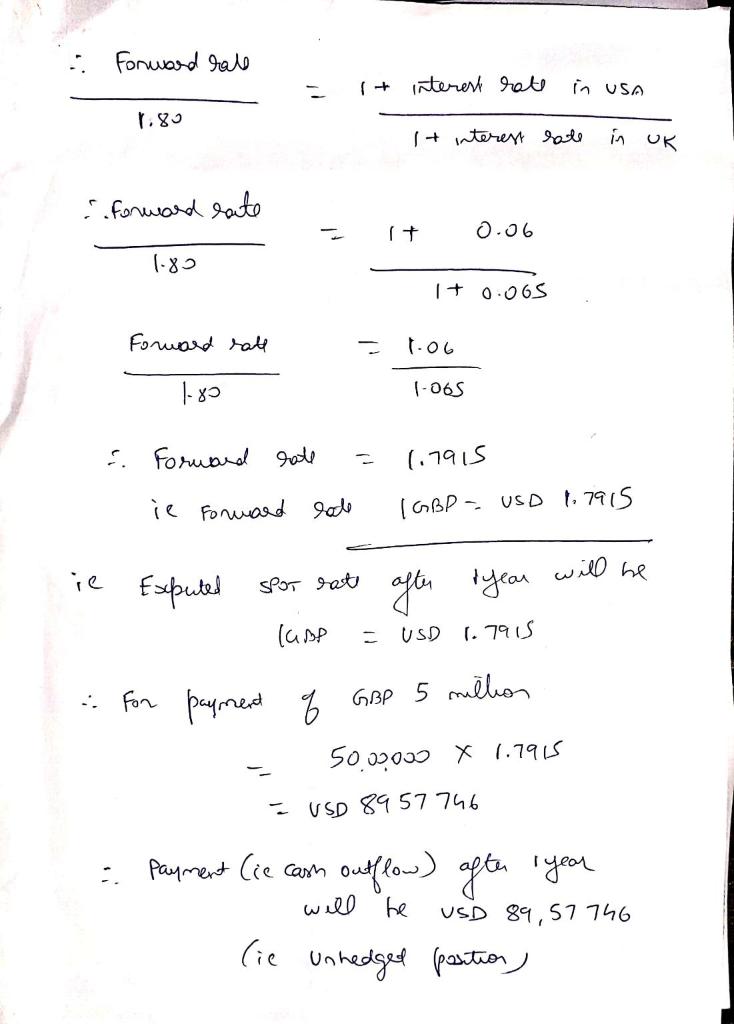

Boeing imports a Rolls Royce jet engine. It will pay GPB 5 Million, payable in 1 year. The following information is given: RUS = 6.0% (interest rate in the US) RUK = 6.5% (interest rate in the UK) S0= 1.80 USD/GPB (spot exchange rate today) F = 1.75 USD/GBP (the one-year forward rate) T= 1 year Call premium: 0.02 USD/GPB 1

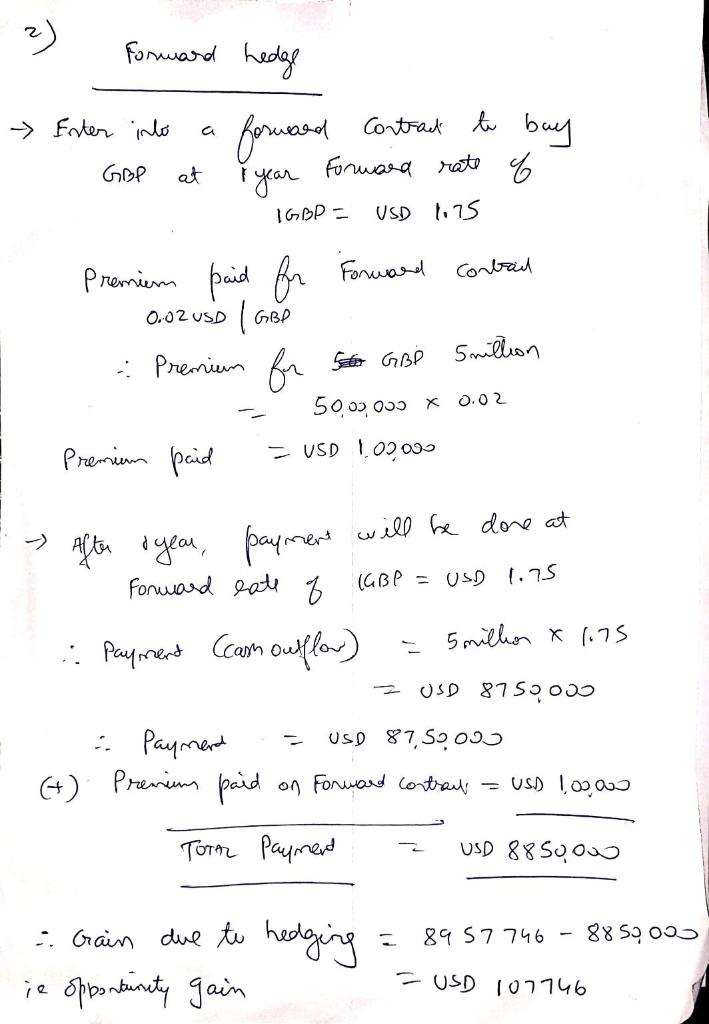

3. Depict the option hedge (before the premium and net of the premium)

4. Obtain the break-even point that determines the choice between forward and option hedge.

Additional Info (Previous Questions):

1. Depict the full exposure to exchange rate risk (the unhedged position)

2. Depict the forward hedge and identify the opportunity gains and losses

in USA - Import of a Rolls Royce Jet Engine Payment of GBP 5 mlhon payable in I year Interest rate Interest rate in UK - 6.57. Spor exchange ret today [ GBP = USD 1-80 1 year Forward hate (GBP = USD 1.75 call Preinen 0.02 USD GBP 2) hedging is done, payment will prevailing spot rate cet the unhedged position If be done after year SPOT rate after after year, parity Theory As pu Interest late parity Theory we To Calulete use Interest rate forward rale interest rate in Home 1 + Country SloT rade foreign + interest rate in Contry Forward rale 1 + interest rate in USA It interest rate in UK forward late 0.06 ( 1-80 1 + 0.065 Forward rate 1.06 1-83 1-065 & Forward rate 1.7915 1 GBP - USD 1.7915 ie Forward role will he " ie Esputed spot rate ( lapp after year USD 1.7915 : For payment of GBP 5 million 500.000 X 1.7915 - USD 8957746 he payment (ie cash outflow) after 1 year will USD 89,57746 Unhedged paction, (ie unhedged Forward hedge - Enter into forward contract to buy r year Forward rate of GBP at 1GBP USD 1,75 Conban Premiem paid fr Forward 0.02 USD (GBP Premium for 5 GBP Smilton 5000 000 X 0.02 - USD 100000 Premium paid will be done at After a year, payment Forward eate 7 (GBP = USD 1.75 :: Payment Camoullor) - 5 milhos x 1.75 = USD 875900 Payment USD 87.50000 (+) Premium paid on Forward contrat - USD 100,00 Torn Payment USD 88500 . 8957746 - 8850005 - Gain due to hedging ie opportunity gain = USD 107746 in USA - Import of a Rolls Royce Jet Engine Payment of GBP 5 mlhon payable in I year Interest rate Interest rate in UK - 6.57. Spor exchange ret today [ GBP = USD 1-80 1 year Forward hate (GBP = USD 1.75 call Preinen 0.02 USD GBP 2) hedging is done, payment will prevailing spot rate cet the unhedged position If be done after year SPOT rate after after year, parity Theory As pu Interest late parity Theory we To Calulete use Interest rate forward rale interest rate in Home 1 + Country SloT rade foreign + interest rate in Contry Forward rale 1 + interest rate in USA It interest rate in UK forward late 0.06 ( 1-80 1 + 0.065 Forward rate 1.06 1-83 1-065 & Forward rate 1.7915 1 GBP - USD 1.7915 ie Forward role will he " ie Esputed spot rate ( lapp after year USD 1.7915 : For payment of GBP 5 million 500.000 X 1.7915 - USD 8957746 he payment (ie cash outflow) after 1 year will USD 89,57746 Unhedged paction, (ie unhedged Forward hedge - Enter into forward contract to buy r year Forward rate of GBP at 1GBP USD 1,75 Conban Premiem paid fr Forward 0.02 USD (GBP Premium for 5 GBP Smilton 5000 000 X 0.02 - USD 100000 Premium paid will be done at After a year, payment Forward eate 7 (GBP = USD 1.75 :: Payment Camoullor) - 5 milhos x 1.75 = USD 875900 Payment USD 87.50000 (+) Premium paid on Forward contrat - USD 100,00 Torn Payment USD 88500 . 8957746 - 8850005 - Gain due to hedging ie opportunity gain = USD 107746

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts