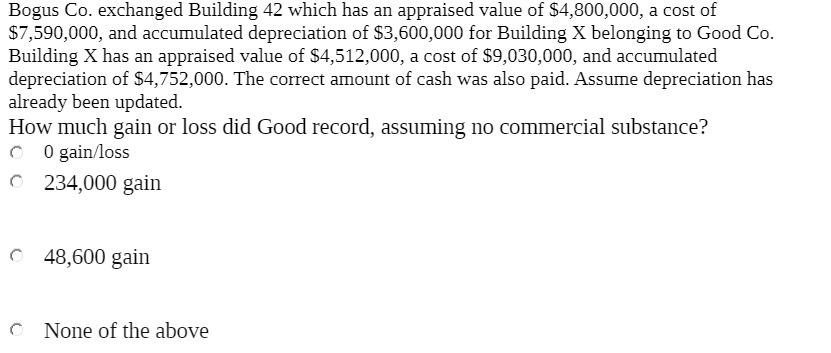

Question: Bogus Co. exchanged Building 42 which has an appraised value of $4,800,000, a cost of $7',590,000, and accumulated depreciation of $3,600,000 for Building X belonging

Bogus Co. exchanged Building 42 which has an appraised value of $4,800,000, a cost of $7',590,000, and accumulated depreciation of $3,600,000 for Building X belonging to Good Co. Building X has an appraised value of $4,512,000, a cost of $9,030,000, and accumulated depreciation of $4,752,000. The correct amount of cash was also paid. Assume depreciation has already been updated. How much gain or loss did Good record, assuming no commercial substance? I\" 0 gainfloss r" 234,000 gain F 48,600 gain f\" None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts