Question: Bollocks Corp. is evaluating a possible change to their AR policy. Currently, they have $150,000 in sales on which they earn a profit margin of

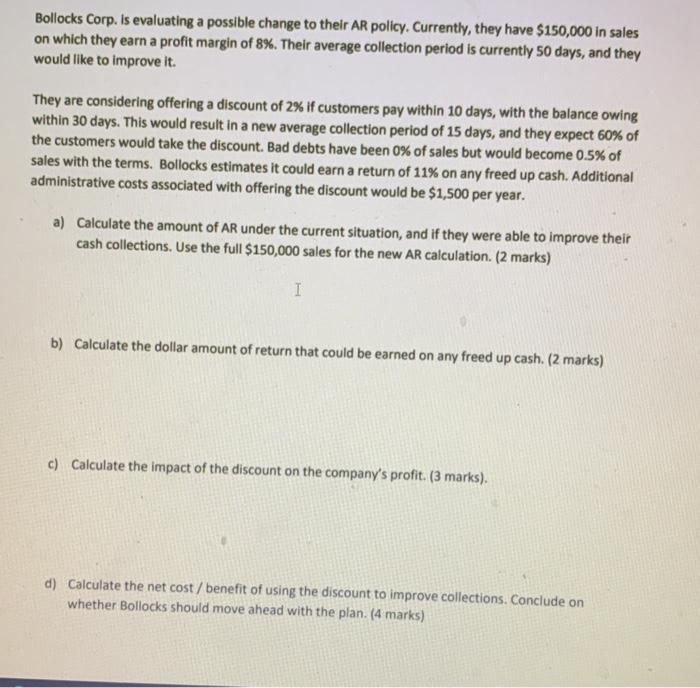

Bollocks Corp. is evaluating a possible change to their AR policy. Currently, they have $150,000 in sales on which they earn a profit margin of 8%. Their average collection period is currently 50 days, and they would like to improve it. They are considering offering a discount of 2% if customers pay within 10 days, with the balance owing within 30 days. This would result in a new average collection period of 15 days, and they expect 60% of the customers would take the discount. Bad debts have been 0% of sales but would become 0.5% of sales with the terms. Bollocks estimates it could earn a return of 11% on any freed up cash. Additional administrative costs associated with offering the discount would be $1,500 per year. a) Calculate the amount of AR under the current situation, and if they were able to improve their cash collections. Use the full $150,000 sales for the new AR calculation. (2 marks) I b) Calculate the dollar amount of return that could be earned on any freed up cash. (2 marks) c) Calculate the impact of the discount on the company's profit. (3 marks). d) Calculate the net cost/benefit of using the discount to improve collections. Conclude on whether Bollocks should move ahead with the plan. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts