Question: Bond: 9% Coupon--Compounded Semiannually $100 FACE Value Yield 7.5% 18 years until maturity Price $114.6856 Duration 9.7941 Convexity 130.2055 PART B: Estimating prices 5. Find

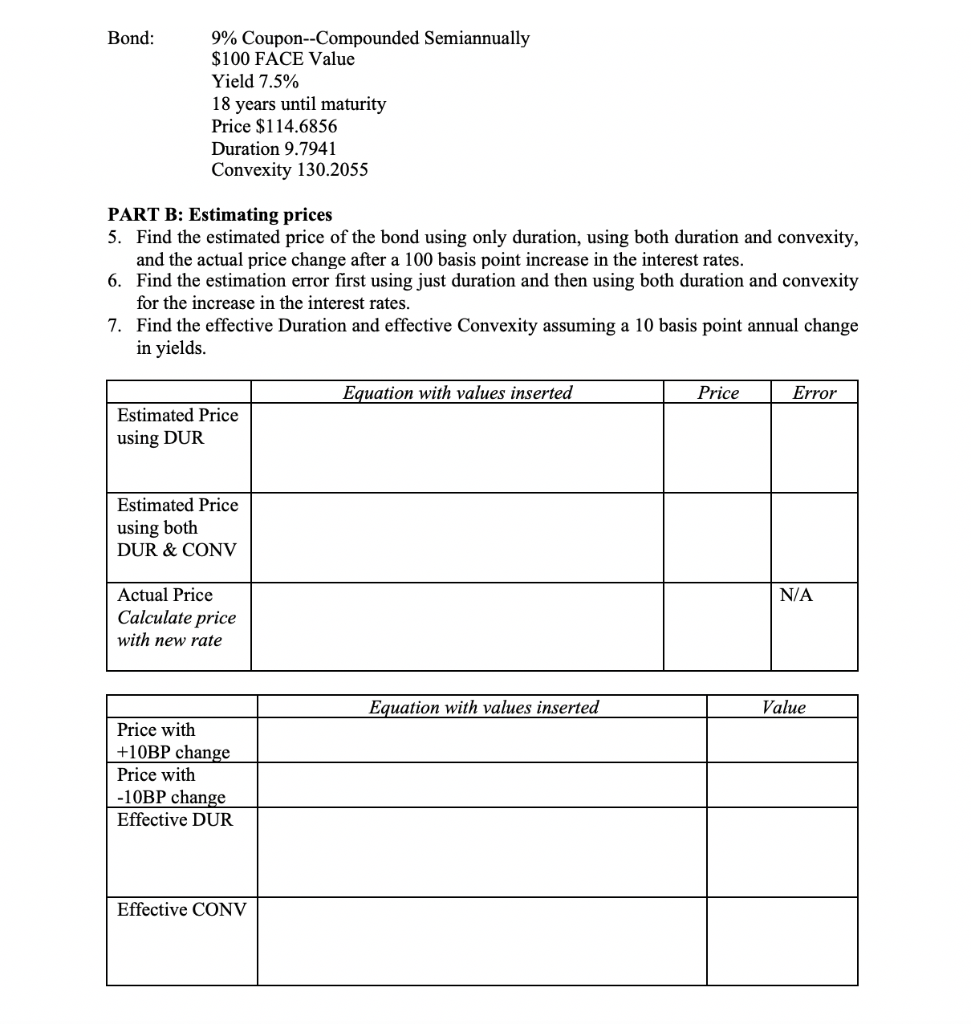

Bond: 9% Coupon--Compounded Semiannually $100 FACE Value Yield 7.5% 18 years until maturity Price $114.6856 Duration 9.7941 Convexity 130.2055 PART B: Estimating prices 5. Find the estimated price of the bond using only duration, using both duration and convexity, and the actual price change after a 100 basis point increase in the interest rates. 6. Find the estimation error first using just duration and then using both duration and convexity for the increase in the interest rates. 7. Find the effective Duration and effective Convexity assuming a 10 basis point annual change in yields. Equation with values inserted Price Error Estimated Price using DUR Estimated Price using both DUR & CONV N/A Actual Price Calculate price with new rate Equation with values inserted Value Price with +10BP change Price with -10BP change Effective DUR Effective CONV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts