Question: Bond A is a two year zero coupon bond with par value of $1000 and price of $950. Bond B is a three year

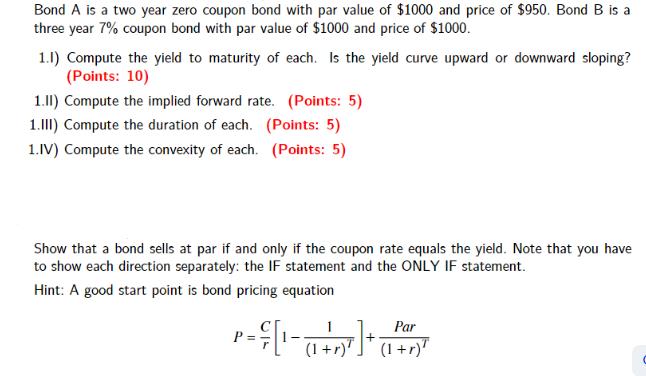

Bond A is a two year zero coupon bond with par value of $1000 and price of $950. Bond B is a three year 7% coupon bond with par value of $1000 and price of $1000. 1.1) Compute the yield to maturity of each. Is the yield curve upward or downward sloping? (Points: 10) 1.11) Compute the implied forward rate. (Points: 5) 1.III) Compute the duration of each. (Points: 5) 1.IV) Compute the convexity of each. (Points: 5) Show that a bond sells at par if and only if the coupon rate equals the yield. Note that you have to show each direction separately: the IF statement and the ONLY IF statement. Hint: A good start point is bond pricing equation P = [1 ( 1 + ] + Par (1+r) C

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Answer 1 2 year rate10009501212597835 3 year ytmcoupon rate7 as pricep... View full answer

Get step-by-step solutions from verified subject matter experts