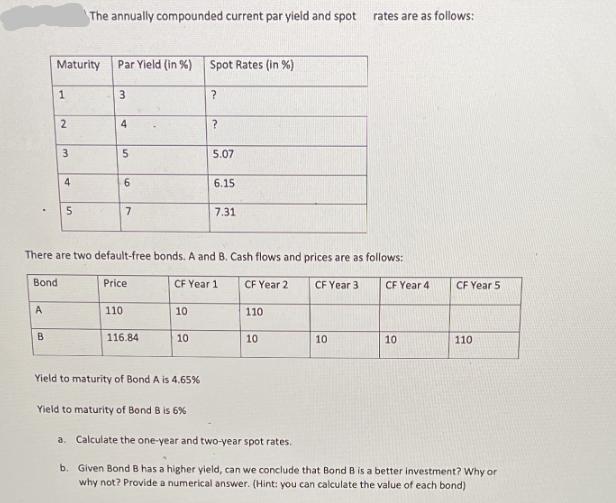

Question: Bond A Maturity B 1 2 3 4 The annually compounded current par yield and spot rates are as follows: 5 Par Yield (in

Bond A Maturity B 1 2 3 4 The annually compounded current par yield and spot rates are as follows: 5 Par Yield (in %) Spot Rates (in %) 3 4 5 6 7 110 Price There are two default-free bonds. A and B. Cash flows and prices are as follows: CF Year 1 CF Year 3 116.84 10 ? 10 ? 5.07 6.15 7.31 CF Year 2 110 10 10 CF Year 4 10 CF Year 5 110 Yield to maturity of Bond A is 4.65% Yield to maturity of Bond B is 6% a. Calculate the one-year and two-year spot rates. b. Given Bond B has a higher yield, can we conclude that Bond B is a better investment? Why or why not? Provide a numerical answer. (Hint: you can calculate the value of each bond)

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

a The one year spot rate will equal the one year par rate 3 For the 2 ye... View full answer

Get step-by-step solutions from verified subject matter experts