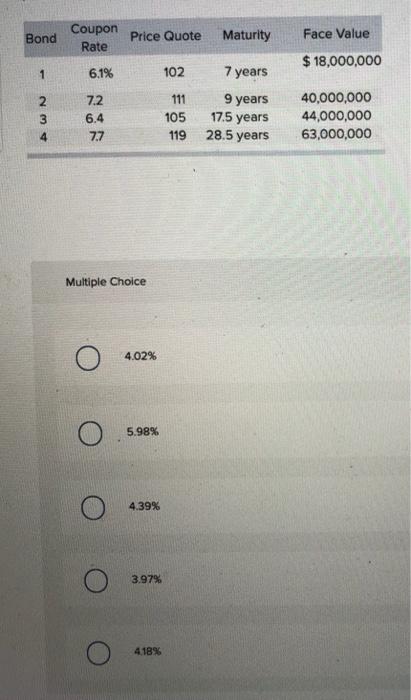

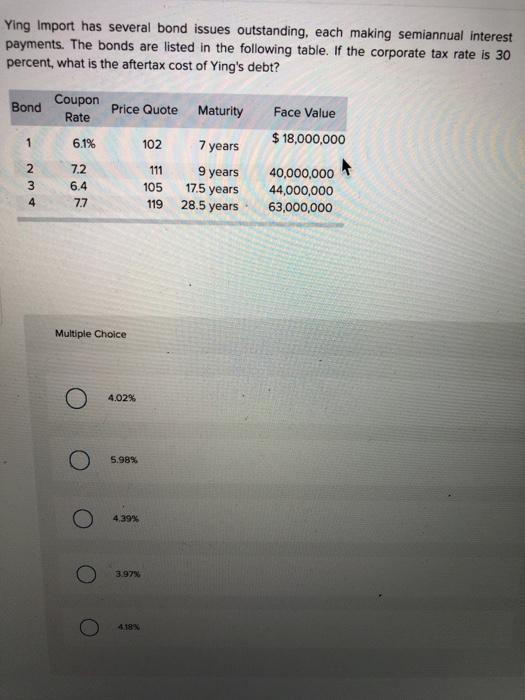

Question: Bond Coupon Rate Price Quote Maturity Face Value $ 18,000,000 1 6.1% 102 7 years 2 3 7.2 6.4 77 111 105 119 9 years

Bond Coupon Rate Price Quote Maturity Face Value $ 18,000,000 1 6.1% 102 7 years 2 3 7.2 6.4 77 111 105 119 9 years 17.5 years 28.5 years 40,000,000 44,000,000 63,000,000 4 Multiple Choice 4.02% 5.98% 4.39% 3.97% 4.18% Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. If the corporate tax rate is 30 percent, what is the aftertax cost of Ying's debt? Bond Coupon Rate Price Quote Maturity Face Value $ 18,000,000 1 6.1% 102 NM 7.2 6.4 7.7 111 105 119 7 years 9 years 17.5 years 28.5 years 40,000,000 44,000,000 63,000,000 4 Multiple Choice 4.02% 5.98% 4,39% 3.97% 4.18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts