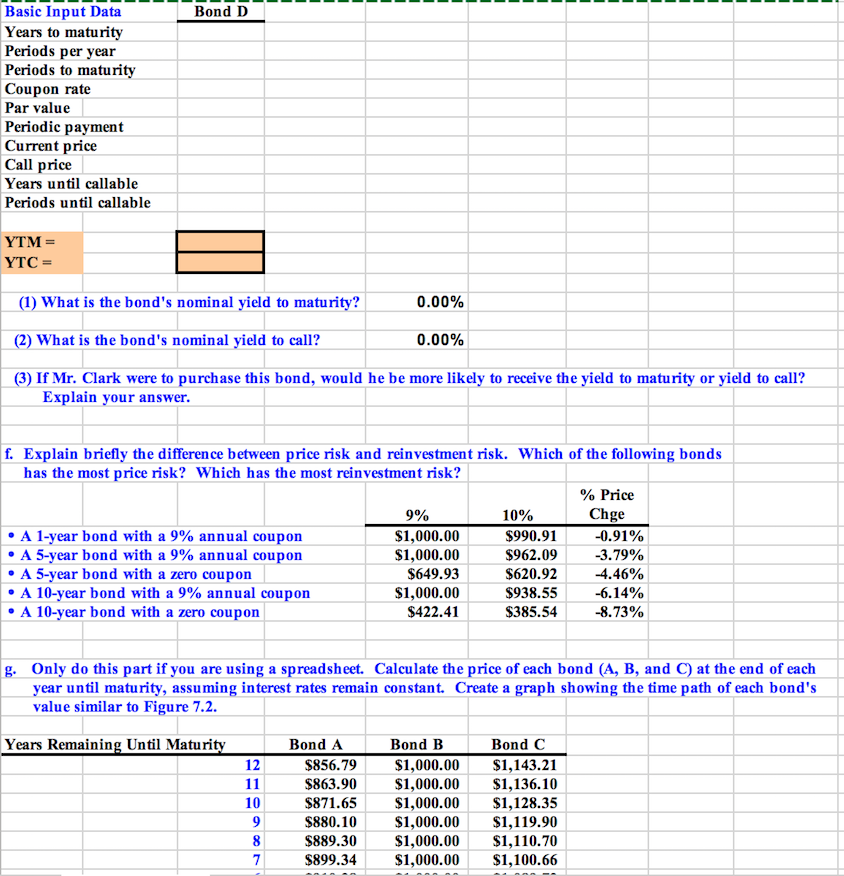

Question: Bond D Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Current price Call price Years

Bond D Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Current price Call price Years until callable Periods until callable YTM= YTC = (1) What is the bond's nominal yield to maturity? 0.00% (2) What is the bond's nominal yield to call? 0.00% (3) If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. f. Explain briefly the difference between price risk and reinvestment risk. Which of the following bonds has the most price risk? Which has the most reinvestment risk? % Price 9% 10% Chge A 1-year bond with a 9% annual coupon $1,000.00 $990.91 -0.91% A 5-year bond with a 9% annual coupon $1,000.00 $962.09 -3.79% A 5-year bond with a zero coupon $649.93 $620.92 4.46% A 10-year bond with a 9% annual coupon $1,000.00 $938.55 -6.14% A 10-year bond with a zero coupon $422.41 $385.54 -8.73% g. Only do this part if you are using a spreadsheet. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Create a graph showing the time path of each bond's value similar to Figure 7.2. Years Remaining Until Maturity 12 11 10 9 8 7 Bond A $856.79 $863.90 $871.65 $880.10 $889.30 $899.34 Bond B $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Bond C $1,143.21 $1,136.10 $1,128.35 $1,119.90 $1,110.70 $1,100.66 Bond D Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Current price Call price Years until callable Periods until callable YTM= YTC = (1) What is the bond's nominal yield to maturity? 0.00% (2) What is the bond's nominal yield to call? 0.00% (3) If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. f. Explain briefly the difference between price risk and reinvestment risk. Which of the following bonds has the most price risk? Which has the most reinvestment risk? % Price 9% 10% Chge A 1-year bond with a 9% annual coupon $1,000.00 $990.91 -0.91% A 5-year bond with a 9% annual coupon $1,000.00 $962.09 -3.79% A 5-year bond with a zero coupon $649.93 $620.92 4.46% A 10-year bond with a 9% annual coupon $1,000.00 $938.55 -6.14% A 10-year bond with a zero coupon $422.41 $385.54 -8.73% g. Only do this part if you are using a spreadsheet. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Create a graph showing the time path of each bond's value similar to Figure 7.2. Years Remaining Until Maturity 12 11 10 9 8 7 Bond A $856.79 $863.90 $871.65 $880.10 $889.30 $899.34 Bond B $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 $1,000.00 Bond C $1,143.21 $1,136.10 $1,128.35 $1,119.90 $1,110.70 $1,100.66

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts