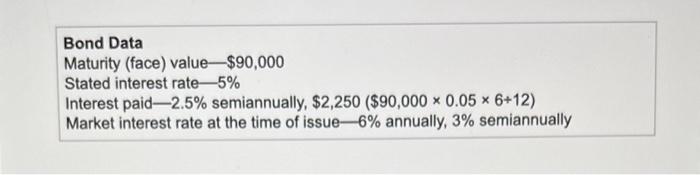

Question: Bond Data Maturity (face) value $90,000 Stated interest rate 5% Interest paid-2.5% semiannually, $2,250($90,0000.056+12) Market interest rate at the time of issue- 6% annually, 3%

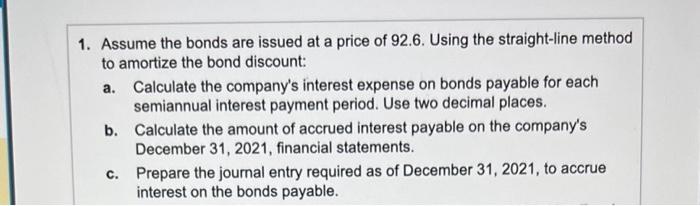

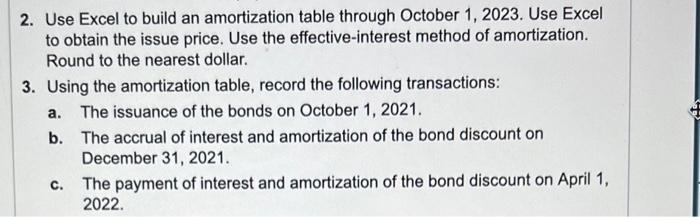

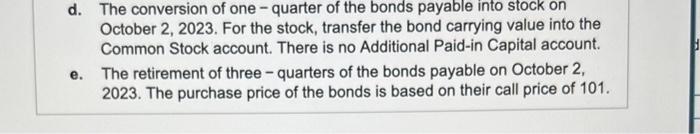

Bond Data Maturity (face) value $90,000 Stated interest rate 5% Interest paid-2.5\% semiannually, $2,250($90,0000.056+12) Market interest rate at the time of issue- 6% annually, 3% semiannually 1. Assume the bonds are issued at a price of 92.6. Using the straight-line method to amortize the bond discount: a. Calculate the company's interest expense on bonds payable for each semiannual interest payment period. Use two decimal places. b. Calculate the amount of accrued interest payable on the company's December 31, 2021, financial statements. c. Prepare the journal entry required as of December 31,2021 , to accrue interest on the bonds payable. 2. Use Excel to build an amortization table through October 1, 2023. Use Excel to obtain the issue price. Use the effective-interest method of amortization. Round to the nearest dollar. 3. Using the amortization table, record the following transactions: a. The issuance of the bonds on October 1,2021. b. The accrual of interest and amortization of the bond discount on December 31, 2021. c. The payment of interest and amortization of the bond discount on April 1 , 2022. d. The conversion of one-quarter of the bonds payable into stock on October 2, 2023. For the stock, transfer the bond carrying value into the Common Stock account. There is no Additional Paid-in Capital account. e. The retirement of three - quarters of the bonds payable on October 2 , 2023. The purchase price of the bonds is based on their call price of 101. The Pioneer Aircraft Company has issued 5% convertible bonds that mature October 1,2029 . Suppose the bonds are issued October 1, 2021, and pay interest each April 1 and October 1. (Click the icon to view the bond data.) Read the Bond Data Maturity (face) value $90,000 Stated interest rate 5% Interest paid-2.5\% semiannually, $2,250($90,0000.056+12) Market interest rate at the time of issue- 6% annually, 3% semiannually 1. Assume the bonds are issued at a price of 92.6. Using the straight-line method to amortize the bond discount: a. Calculate the company's interest expense on bonds payable for each semiannual interest payment period. Use two decimal places. b. Calculate the amount of accrued interest payable on the company's December 31, 2021, financial statements. c. Prepare the journal entry required as of December 31,2021 , to accrue interest on the bonds payable. 2. Use Excel to build an amortization table through October 1, 2023. Use Excel to obtain the issue price. Use the effective-interest method of amortization. Round to the nearest dollar. 3. Using the amortization table, record the following transactions: a. The issuance of the bonds on October 1,2021. b. The accrual of interest and amortization of the bond discount on December 31, 2021. c. The payment of interest and amortization of the bond discount on April 1 , 2022. d. The conversion of one-quarter of the bonds payable into stock on October 2, 2023. For the stock, transfer the bond carrying value into the Common Stock account. There is no Additional Paid-in Capital account. e. The retirement of three - quarters of the bonds payable on October 2 , 2023. The purchase price of the bonds is based on their call price of 101. The Pioneer Aircraft Company has issued 5% convertible bonds that mature October 1,2029 . Suppose the bonds are issued October 1, 2021, and pay interest each April 1 and October 1. (Click the icon to view the bond data.) Read the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts