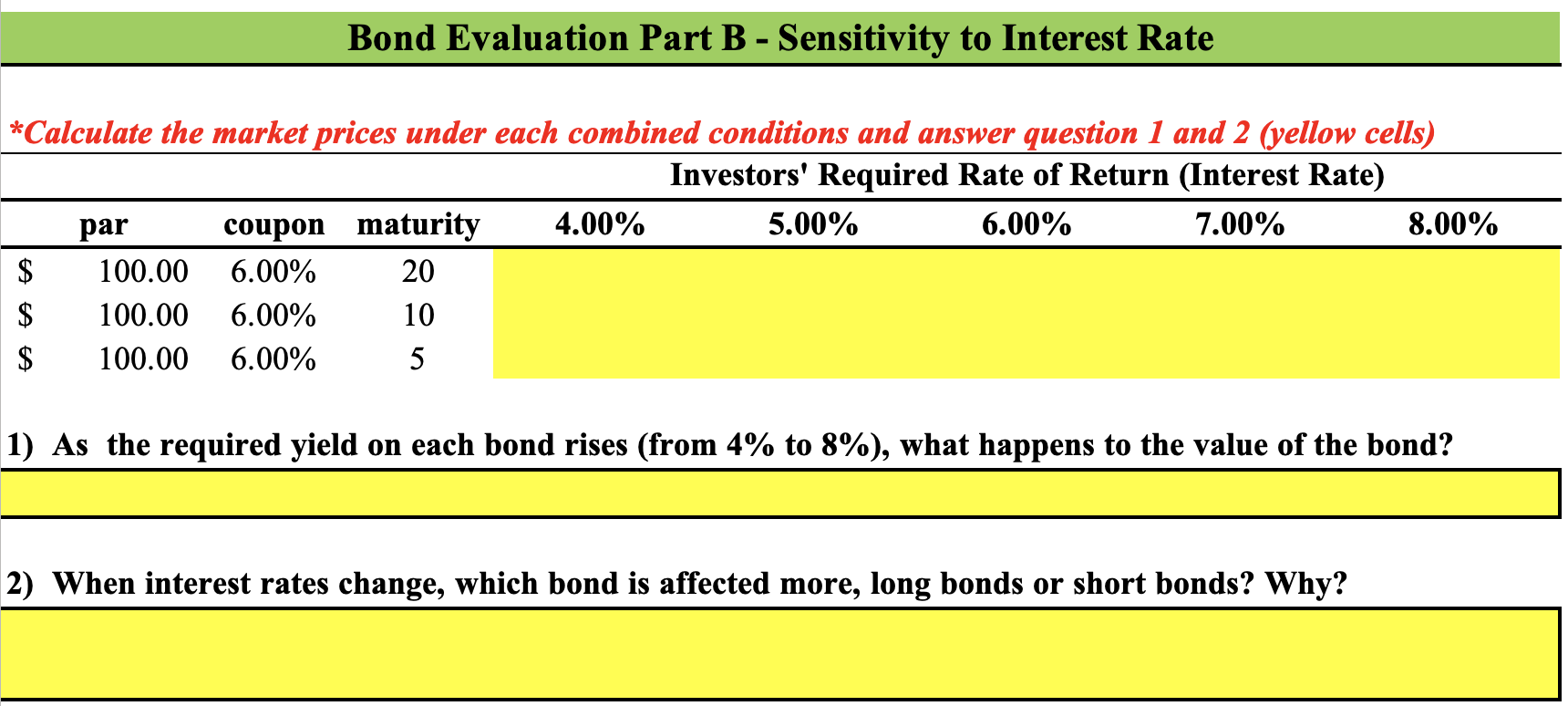

Question: Bond Evaluation Part B - Sensitivity to Interest Rate *Calculate the market prices under each combined conditions and answer question 1 and 2 (yellow cells)

Bond Evaluation Part B - Sensitivity to Interest Rate *Calculate the market prices under each combined conditions and answer question 1 and 2 (yellow cells) Investors' Required Rate of Return (Interest Rate) par coupon maturity 4.00% 5.00% 6.00% 7.00% 8.00% $ 100.00 6.00% 20 $ 100.00 6.00% 10 $ 100.00 6.00% 5 1) As the required yield on each bond rises (from 4% to 8%), what happens to the value of the bond? 2) When interest rates change, which bond is affected more, long bonds or short bonds? Why

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock