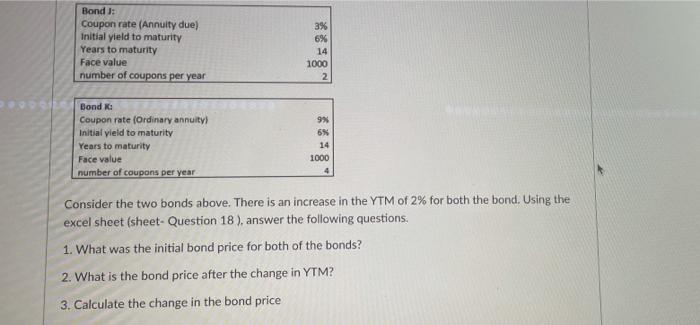

Question: Bond J: Coupon rate (Annuity due) Initial yield to maturity Years to maturity Face value number of coupons per year 3% 6% 14 1000 2

Bond J: Coupon rate (Annuity due) Initial yield to maturity Years to maturity Face value number of coupons per year 3% 6% 14 1000 2 PO Bond Coupon rate (Ordinary annuity) Initial yield to maturity Years to maturity Face value number of coupons per year 9% 6% 14 1000 Consider the two bonds above. There is an increase in the YTM of 2% for both the bond. Using the excel sheet (sheet- Question 18 ), answer the following questions 1. What was the initial bond price for both of the bonds? 2. What is the bond price after the change in YTM? 3. Calculate the change in the bond price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock