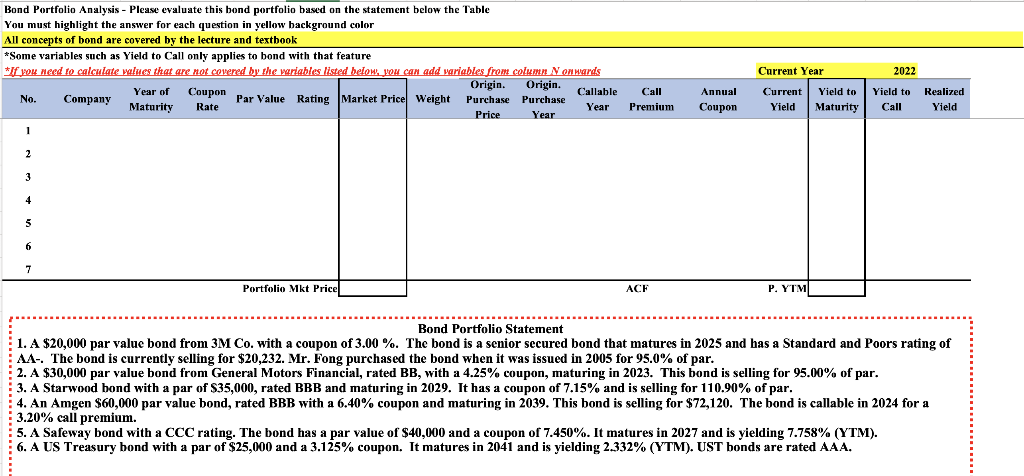

Question: Bond Portfolio Analysis - Please evaluate this bond portfolio based on the statement below the Table You must highlight the answer for each question in

Bond Portfolio Analysis - Please evaluate this bond portfolio based on the statement below the Table You must highlight the answer for each question in yellow background color All concepts of bond are covered by the lecture and textbook *Some variables such as Yield to Call only applies to bond with that feature *If you need to calculate values that are not covered by the variables listed below. You can add variables from column Nonwards Year of Origin. Origin Callable Coupon Par Value Rating Market Price Weight Purchase Purchase No. Maturity Rate Year Price Year 1 Current Year 2022 Company Call Premium Annual Coupon Current Yield Yield to Maturity Yield to Call Realized Yield 2 3 4 5 6 7 Portfolio Mkt Price ACF P. YTM Bond Portfolio Statement 1. A $20,000 par value bond from 3M Co. with a coupon of 3.00 %. The bond is a senior secured bond that matures in 2025 and has a Standard and Poors rating of AA- The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. 2. A $30,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2023. This bond is selling for 95.00% of par. 3. A Starwood bond with a par of S35,000, rated BBB and maturing in 2029. It has a coupon of 7.15% and is selling for 110.90% of par. 4. An Amgen $60,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039. This bond is selling for $72,120. The bond is callable in 2024 for a 3.20% call premium. 5. A Safeway bond with a CCC rating. The bond has a par value of $40,000 and a coupon of 7.450%. It matures in 2027 and is yielding 7.758% (YTM). 6. A US Treasury bond with a par of $25,000 and a 3.125% coupon. It matures in 2041 and is yielding 2.332% (YTM). UST bonds are rated AAA. Bond Portfolio Analysis - Please evaluate this bond portfolio based on the statement below the Table You must highlight the answer for each question in yellow background color All concepts of bond are covered by the lecture and textbook *Some variables such as Yield to Call only applies to bond with that feature *If you need to calculate values that are not covered by the variables listed below. You can add variables from column Nonwards Year of Origin. Origin Callable Coupon Par Value Rating Market Price Weight Purchase Purchase No. Maturity Rate Year Price Year 1 Current Year 2022 Company Call Premium Annual Coupon Current Yield Yield to Maturity Yield to Call Realized Yield 2 3 4 5 6 7 Portfolio Mkt Price ACF P. YTM Bond Portfolio Statement 1. A $20,000 par value bond from 3M Co. with a coupon of 3.00 %. The bond is a senior secured bond that matures in 2025 and has a Standard and Poors rating of AA- The bond is currently selling for $20,232. Mr. Fong purchased the bond when it was issued in 2005 for 95.0% of par. 2. A $30,000 par value bond from General Motors Financial, rated BB, with a 4.25% coupon, maturing in 2023. This bond is selling for 95.00% of par. 3. A Starwood bond with a par of S35,000, rated BBB and maturing in 2029. It has a coupon of 7.15% and is selling for 110.90% of par. 4. An Amgen $60,000 par value bond, rated BBB with a 6.40% coupon and maturing in 2039. This bond is selling for $72,120. The bond is callable in 2024 for a 3.20% call premium. 5. A Safeway bond with a CCC rating. The bond has a par value of $40,000 and a coupon of 7.450%. It matures in 2027 and is yielding 7.758% (YTM). 6. A US Treasury bond with a par of $25,000 and a 3.125% coupon. It matures in 2041 and is yielding 2.332% (YTM). UST bonds are rated AAA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts