Question: Bond Pricing and Yield to Maturity A U . S . Treasury bond ( T - bond ) that matures in 3 years has a

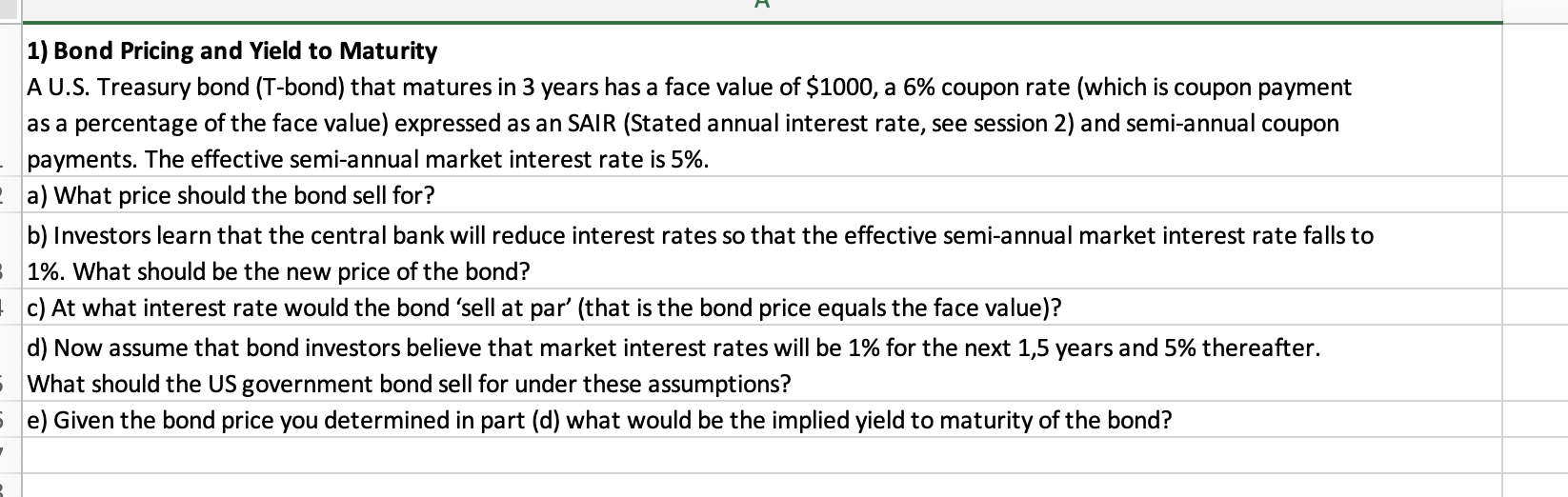

Bond Pricing and Yield to Maturity

A US Treasury bond Tbond that matures in years has a face value of $ a coupon rate which is coupon payment

as a percentage of the face value expressed as an SAIR Stated annual interest rate and semiannual coupon

payments. The effective semiannual market interest rate is

a What price should the bond sell for?

b Investors learn that the central bank will reduce interest rates so that the effective semiannual market interest rate falls to

What should be the new price of the bond?

c At what interest rate would the bond 'sell at par' that is the bond price equals the face value

d Now assume that bond investors believe that market interest rates will be for the next years and thereafter.

What should the US government bond sell for under these assumptions?

e Given the bond price you determined in part d what would be the implied yield to maturity of the bond?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock