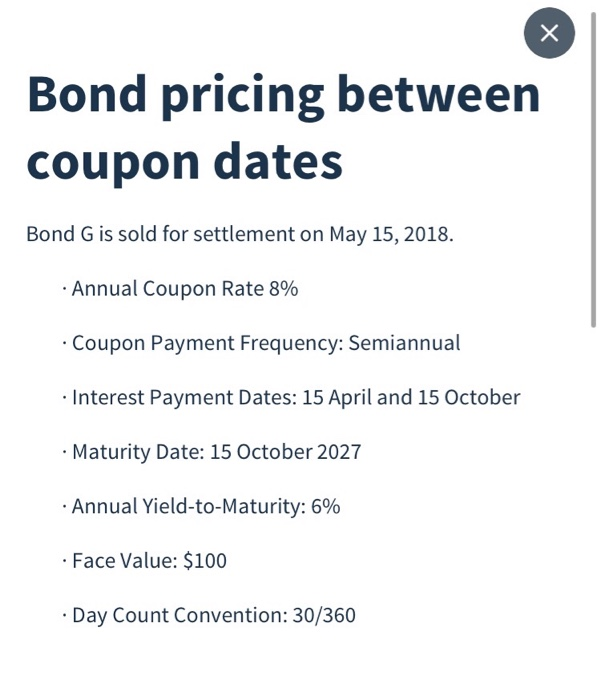

Question: Bond pricing between coupon dates Bond G is sold for settlement on May 15, 2018. Annual Coupon Rate 8% Coupon Payment Frequency: Semiannual Interest Payment

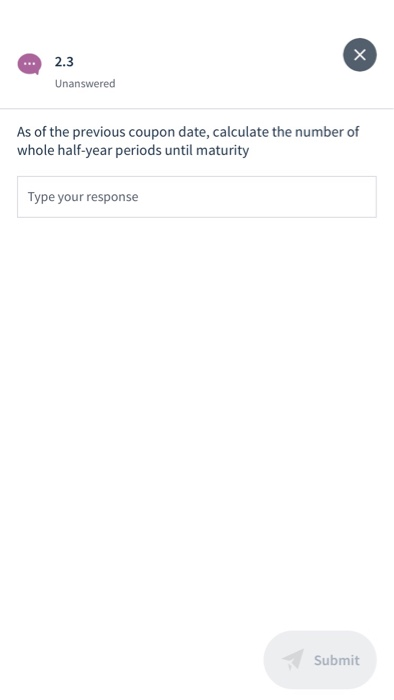

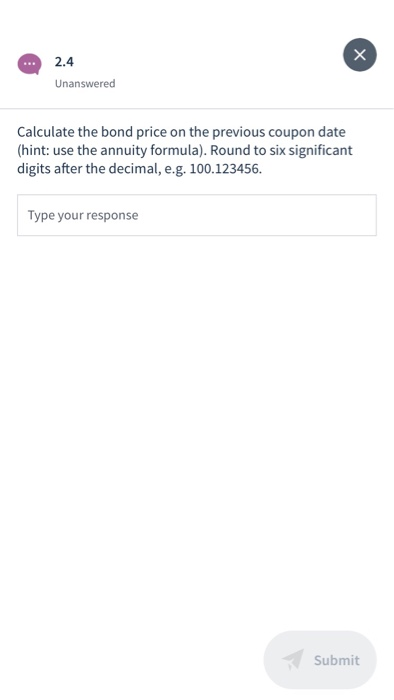

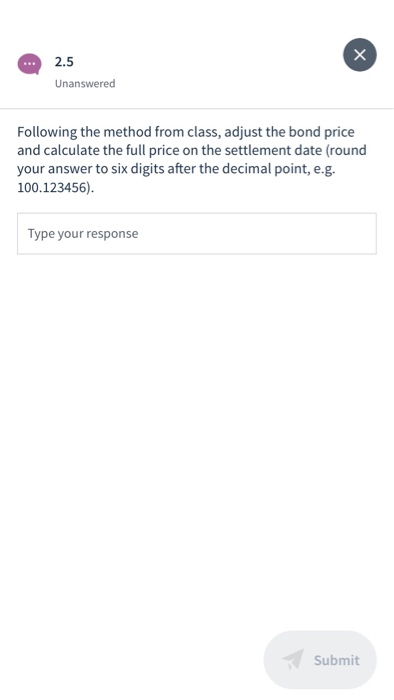

Bond pricing between coupon dates Bond G is sold for settlement on May 15, 2018. Annual Coupon Rate 8% Coupon Payment Frequency: Semiannual Interest Payment Dates: 15 April and 15 October Maturity Date: 15 October 2027 Annual Yield-to-Maturity: 6% Face Value: $100 Day Count Convention: 30/360 2.3 Unanswered As of the previous coupon date, calculate the number of whole half-year periods until maturity Type your response Submit 2.4 Unanswered Calculate the bond price on the previous coupon date (hint: use the annuity formula). Round to six significant digits after the decimal, e.g. 100.123456. Type your response Submit 2.5 Unanswered Following the method from class, adjust the bond price and calculate the full price on the settlement date (round your answer to six digits after the decimal point, e.g. 100.123456). Type your response Submit 3.1 Unanswered Calculate the flat price of the bond (round your answer to six digits after the decimal point, e.g. 100.123456) Type your response Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts