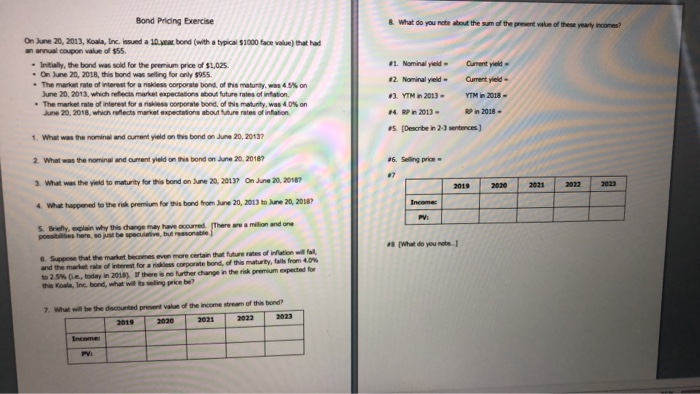

Question: Bond Pricing Exercise & What do you nate about the sum of the present value of these yearly incomes? On June 20, 2013, Koala, Inc.

Bond Pricing Exercise & What do you nate about the sum of the present value of these yearly incomes? On June 20, 2013, Koala, Inc. issued a 10ea bond (with a typical $1000 face value) that had an annual coupon value of $55 Initially,the bond was sold for the premium price of $1,025 #1. Nominal yed- anent yield- . On June 20, 2018, this bond was selling for only $955 The maretrate of interest for a riskless corporate bond of tis matunity, was 4 5% on June 20, 2013, which refiects market expectaions about future rates of infation. The market rate of nterest for ansiass coperate bon. ofni matmy, was 4 O% on June 20, 2018, which reflects market expectations about uture rates of inflation 3. YTM in 2013YTMin 2018- . 5 [Describe in 2-3 sentences] 1. What was the nominal and cument yield on this bond on June 20, 2013 2. What was the nominal and oument yield on this bond on June 20, 20187 #7 3. What was the yield to maturity for this bond on June 20, 20137 On June 20, 20187 4 What happened to the risk premium for this bond from June 20, 2013 to June 20,208 5. Briefly, explain why this change may have occurred 2019 2020 2021 2022 2023 . [There are a milion and one possibilities here, so just be specuiative, but reasonable) #8 (What do you note ] 6. Suppose that the maket becomes even more certain thait future rates of iflation wi a, this matty, talk fon 4,0% and the market rale of interest for a riskless -corporate bond, this Koala, Inc bond, what will its selling price be? 7. What will be the dscounted present value of the income stream of this bond? 9 2020 Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts