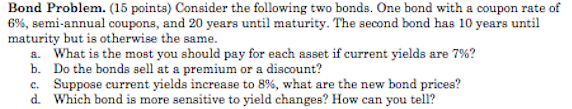

Question: Bond Problem. (15 points) Consider the following two bonds. One bond with a coupon rate of 6%, semi-annual coupons, and 20 years until maturity. The

Bond Problem. (15 points) Consider the following two bonds. One bond with a coupon rate of 6%, semi-annual coupons, and 20 years until maturity. The second bond has 10 years until maturity but is otherwise the same. a. What is the most you should pay for each asset if current yields are 7%? b. Do the bonds sell at a premium or a discount? c. Suppose current yields increase to 8%, what are the new bond prices? d. Which bond is more sensitive to yield changes? How can you tell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts