Question: Bond Rates When we evaluate Bonds, there are three rates to remember: 1. The Coupon Rate outlined in the bond contract and used to find

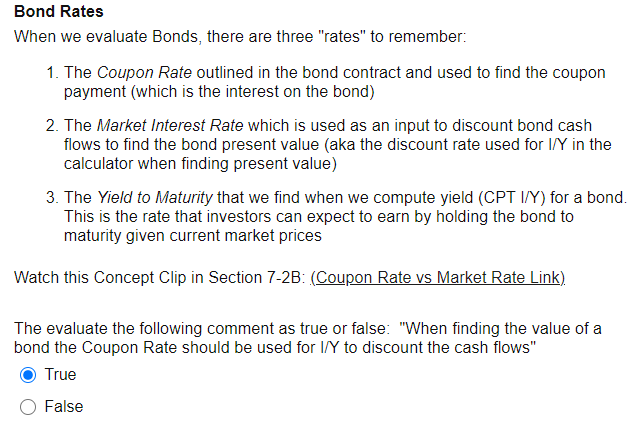

Bond Rates When we evaluate Bonds, there are three "rates" to remember: 1. The Coupon Rate outlined in the bond contract and used to find the coupon payment (which is the interest on the bond) 2. The Market Interest Rate which is used as an input to discount bond cash flows to find the bond present value (aka the discount rate used for I/Y in the calculator when finding present value) 3. The Yield to Maturity that we find when we compute yield (CPT I/Y) for a bond. This is the rate that investors can expect to earn by holding the bond to maturity given current market prices Watch this Concept Clip in Section 7-2B: (Coupon Rate vs Market Rate Link) The evaluate the following comment as true or false: "When finding the value of a bond the Coupon Rate should be used for I/Y to discount the cash flows" True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts