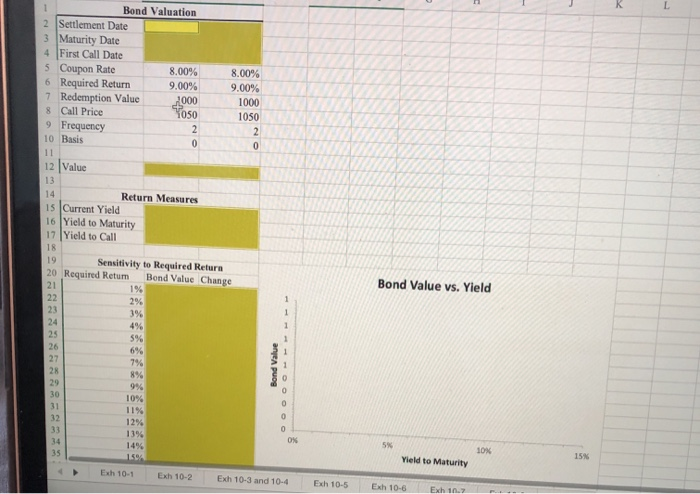

Question: Bond Valuation 2 Settlement Date 3 Maturity Date 4 First Call Date 5 Coupon Rate 8.00% 6 Required Return 9.00% 7 Redemption Value 2000 8

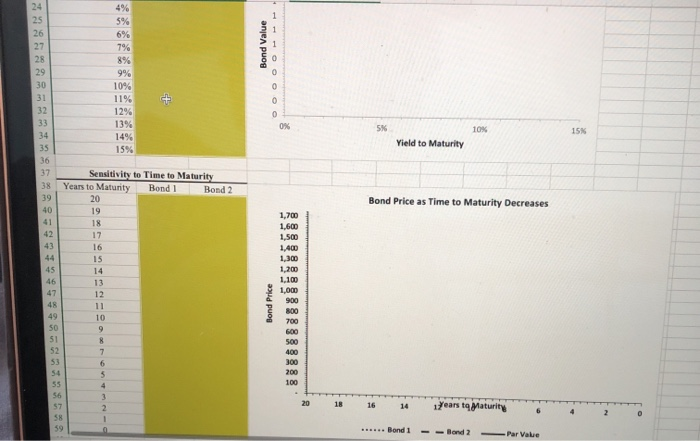

Bond Valuation 2 Settlement Date 3 Maturity Date 4 First Call Date 5 Coupon Rate 8.00% 6 Required Return 9.00% 7 Redemption Value 2000 8 Call Price 1050 9 Frequency 10 Basis 8.00% 9.00% 1000 1050 12 Value Return Measures 15 Current Yield 16 Yield to Maturity 17 Yield to Call 18 Sensitivity to Required Return 20 Required Retum Bond Value Change Bond Value vs. Yleld Bond Value SON Yield to Maturity Exh 10-1 Exh 10-2 Exh 10-3 and 10-4 Exh 10-5 Exh 10-6 Exh . Bond Value 8% 104 Yield to Maturity Sensitivity to Time to Maturity Years to Maturity Bond Bond 2 20 Bond Price as Time to Maturity Decreases 1.700 1.400 1,300 1.200 1,100 Bond Price 700 Years to Maturity .. Bondi - -Band 2 Par Valve Bond Valuation 2 Settlement Date 3 Maturity Date 4 First Call Date 5 Coupon Rate 8.00% 6 Required Return 9.00% 7 Redemption Value 2000 8 Call Price 1050 9 Frequency 10 Basis 8.00% 9.00% 1000 1050 12 Value Return Measures 15 Current Yield 16 Yield to Maturity 17 Yield to Call 18 Sensitivity to Required Return 20 Required Retum Bond Value Change Bond Value vs. Yleld Bond Value SON Yield to Maturity Exh 10-1 Exh 10-2 Exh 10-3 and 10-4 Exh 10-5 Exh 10-6 Exh . Bond Value 8% 104 Yield to Maturity Sensitivity to Time to Maturity Years to Maturity Bond Bond 2 20 Bond Price as Time to Maturity Decreases 1.700 1.400 1,300 1.200 1,100 Bond Price 700 Years to Maturity .. Bondi - -Band 2 Par Valve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts