Question: Bond Valuation (40 points) 1. A$ 1,000 par value bond makes annual coupon payment of $95. If it offers a yield to maturity of 6.5%

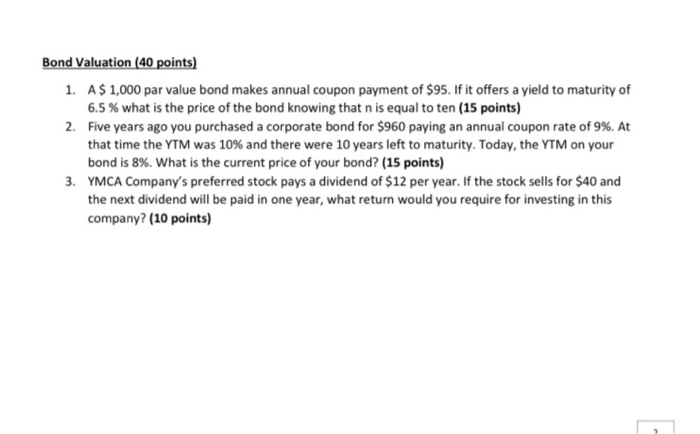

Bond Valuation (40 points) 1. A$ 1,000 par value bond makes annual coupon payment of $95. If it offers a yield to maturity of 6.5% what is the price of the bond knowing that n is equal to ten (15 points) 2. Five years ago you purchased a corporate bond for $960 paying an annual coupon rate of 9%. At that time the YTM was 10% and there were 10 years left to maturity. Today, the YTM on your bond is 8%. What is the current price of your bond? (15 points) 3. YMCA Company's preferred stock pays a dividend of $12 per year. If the stock sells for $40 and the next dividend will be paid in one year, what return would you require for investing in this company? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts