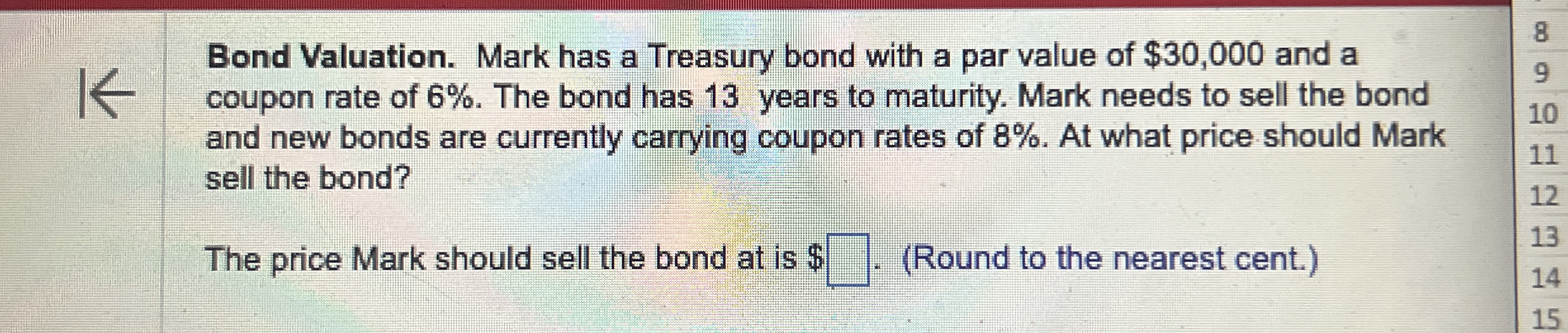

Question: Bond Valuation. Mark has a Treasury bond with a par value of $ 3 0 , 0 0 0 and a coupon rate of 6

Bond Valuation. Mark has a Treasury bond with a par value of $ and a coupon rate of The bond has years to maturity. Mark needs to sell the bond and new bonds are currently carrying coupon rates of At what price should Mark sell the bond?

The price Mark should sell the bond at is $ Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock