Question: Bond Valuation Problem Assignment: Assume the following information for an existing bond that provides annual coupon payments Duration = 3.14 convexity =-2.52 Current Book Value

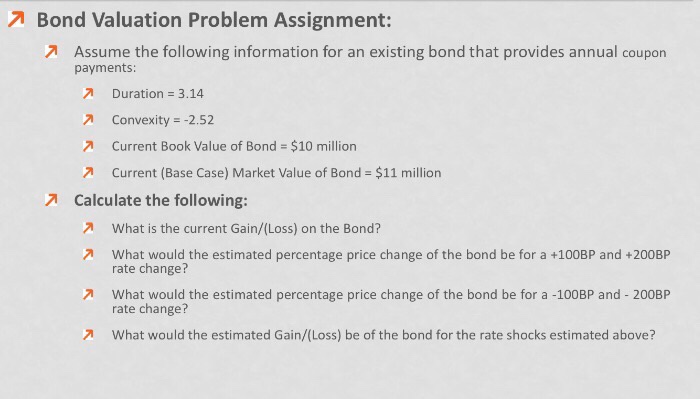

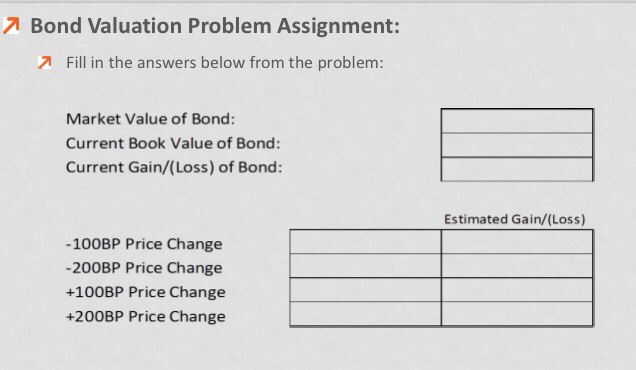

Bond Valuation Problem Assignment: Assume the following information for an existing bond that provides annual coupon payments Duration = 3.14 convexity =-2.52 Current Book Value of Bond = $10 million 2 Current (Base Case) Market Value of Bond $11 million Calculate the following: 2 What is the current Gain/(Loss) on the Bond? What would the estimated percentage price change of the bond be for a +100BP and +200BP rate change? 2 What would the estimated percentage price change of the bond be for a -100BP and - 200BP rate change? 2 What would the estimated Gain/(Loss) be of the bond for the rate shocks estimated above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock