Question: ( Bond valuation ) You are examining three bonds with a par value of $ 1 , 0 0 0 ( you receive $ 1

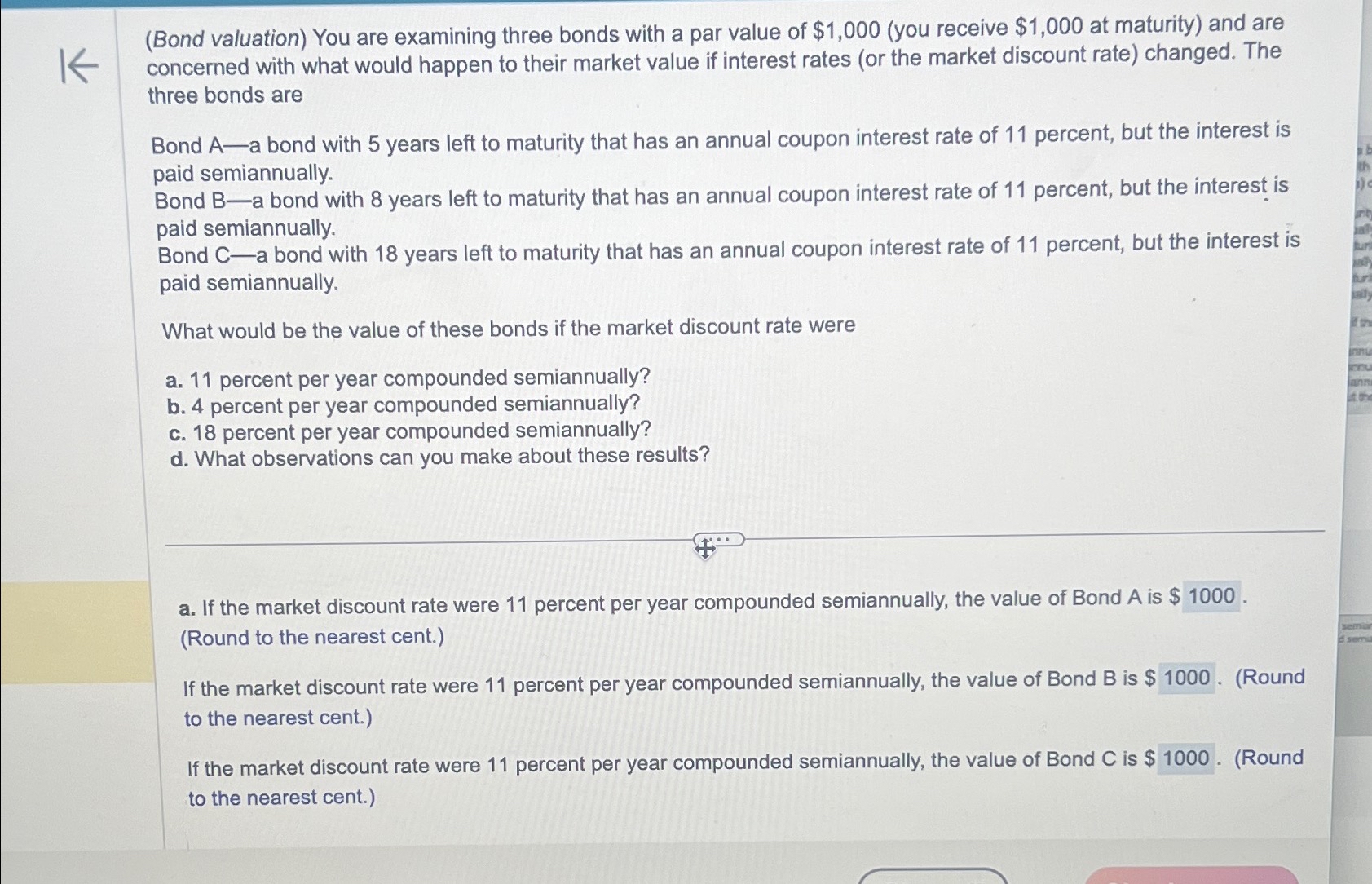

Bond valuation You are examining three bonds with a par value of $you receive $ at maturity and are concerned with what would happen to their market value if interest rates or the market discount rate changed. The three bonds are

Bond a bond with years left to maturity that has an annual coupon interest rate of percent, but the interest is paid semiannually.

Bond a bond with years left to maturity that has an annual coupon interest rate of percent, but the interest is paid semiannually.

Bond a bond with years left to maturity that has an annual coupon interest rate of percent, but the interest is paid semiannually.

What would be the value of these bonds if the market discount rate were

a percent per year compounded semiannually?

b percent per year compounded semiannually?

c percent per year compounded semiannually?

d What observations can you make about these results?

a If the market discount rate were percent per year compounded semiannually, the value of Bond is $ Round to the nearest cent.

If the market discount rate were percent per year compounded semiannually, the value of Bond is $ Round to the nearest cent.

If the market discount rate were percent per year compounded semiannually, the value of Bond is $Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock