Question: Bond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000

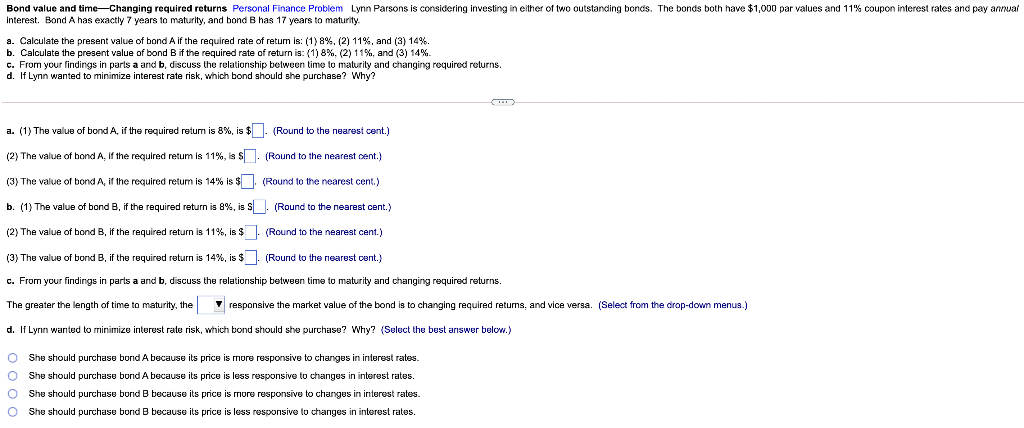

Bond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 11% coupon interest rates and pay annual Interest. Bond A has exactly 7 years to maturity, and bond B has 17 years to maturity. a. Calculate the present value of bond A if the required rate of retum is: (1) 8%. (2) 11%, and (3) 14%. b. Calculate the present value of bond Bif the required rate of return is: (1) 8%, (2) 11%, and (3) 14%. c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? a. (1) The value of bond A, if the required retum is 8%, is $. (Round to the nearest cont.) (2) The value of bond A, If the required retum is 11%, is $. (Round to the nearest cent.) (3) The value of bond A, if the required retum is 14% is $ (Round to the nearest cent.) b. (1) The value of bond B, if the required return is 8%, is S. (Round to the nearest cent.) (2) The value of bond B, if the required return is 11%, is $ (Round to the nearest cent.) (3) The value of bond B, if the required return is 14%, is $7 (Round to the nearest cent.) c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. The greater the length of time to maturity, the responsive the market value of the bond is to changing required retums, and vice versa. (Select from the drop-down menus.) d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? (Select the best answer below.) O She should purchase bond A because its price is more responsive to changes in interest rates. O She should purchase bond A because its price is less responsive to changes in interest rates. O She should purchase bond B because its price is more responsive to changes in interest rates. O She should purchase bond B because its price is less responsive changes in interest rates. Bond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 11% coupon interest rates and pay annual Interest. Bond A has exactly 7 years to maturity, and bond B has 17 years to maturity. a. Calculate the present value of bond A if the required rate of retum is: (1) 8%. (2) 11%, and (3) 14%. b. Calculate the present value of bond Bif the required rate of return is: (1) 8%, (2) 11%, and (3) 14%. c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? a. (1) The value of bond A, if the required retum is 8%, is $. (Round to the nearest cont.) (2) The value of bond A, If the required retum is 11%, is $. (Round to the nearest cent.) (3) The value of bond A, if the required retum is 14% is $ (Round to the nearest cent.) b. (1) The value of bond B, if the required return is 8%, is S. (Round to the nearest cent.) (2) The value of bond B, if the required return is 11%, is $ (Round to the nearest cent.) (3) The value of bond B, if the required return is 14%, is $7 (Round to the nearest cent.) c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. The greater the length of time to maturity, the responsive the market value of the bond is to changing required retums, and vice versa. (Select from the drop-down menus.) d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? (Select the best answer below.) O She should purchase bond A because its price is more responsive to changes in interest rates. O She should purchase bond A because its price is less responsive to changes in interest rates. O She should purchase bond B because its price is more responsive to changes in interest rates. O She should purchase bond B because its price is less responsive changes in interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts