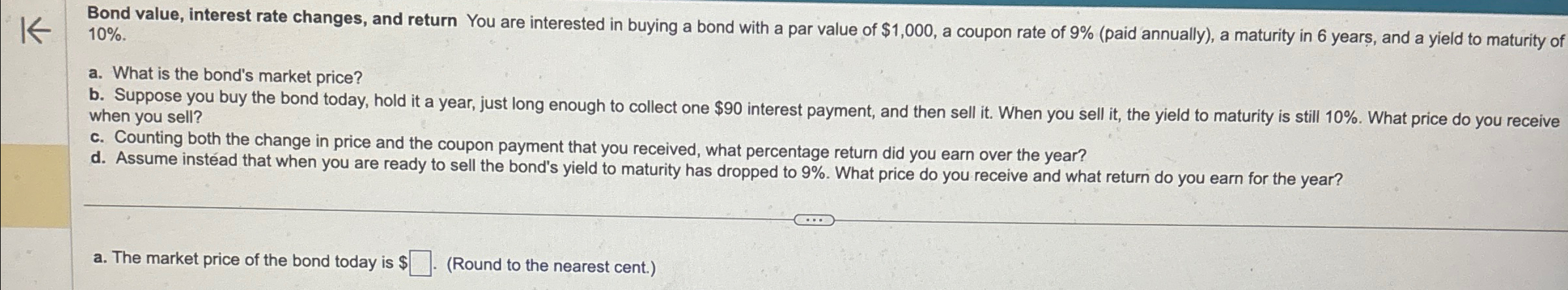

Question: Bond value, interest rate changes, and return You are interested in buying a bond with a par value of $ 1 , 0 0 0

Bond value, interest rate changes, and return You are interested in buying a bond with a par value of $ a coupon rate of paid annually a maturity in years, and a yield to maturity of

a What is the bond's market price?

b Suppose you buy the bond today, hold it a year, just long enough to collect one $ interest payment, and then sell it When you sell it the yield to maturity is still What price do you receive when you sell?

c Counting both the change in price and the coupon payment that you received, what percentage return did you earn over the year?

d Assume instad that when you are ready to sell the bond's yield to maturity has dropped to What price do you receive and what return do you earn for the year?

a The market price of the bond today is $ Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock