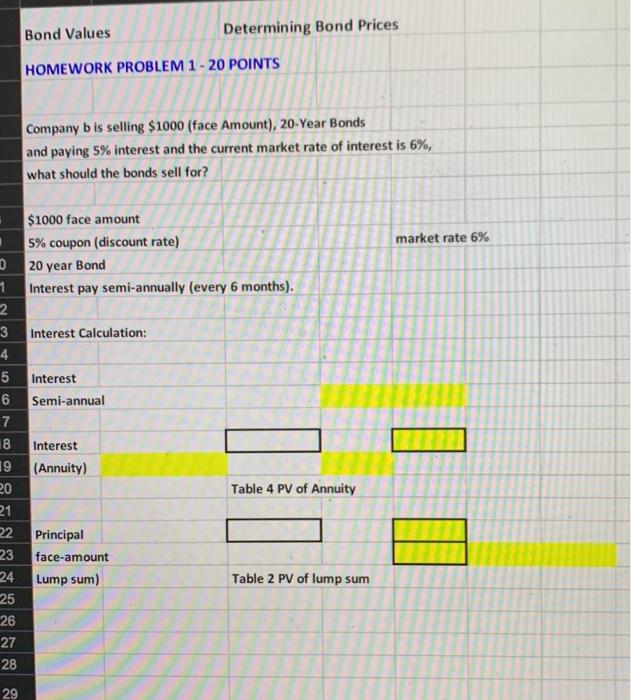

Question: Bond Values Determining Bond Prices HOMEWORK PROBLEM 1 - 20 POINTS Company b is selling $1000 (face Amount), 20-Year Bonds and paying 5% interest and

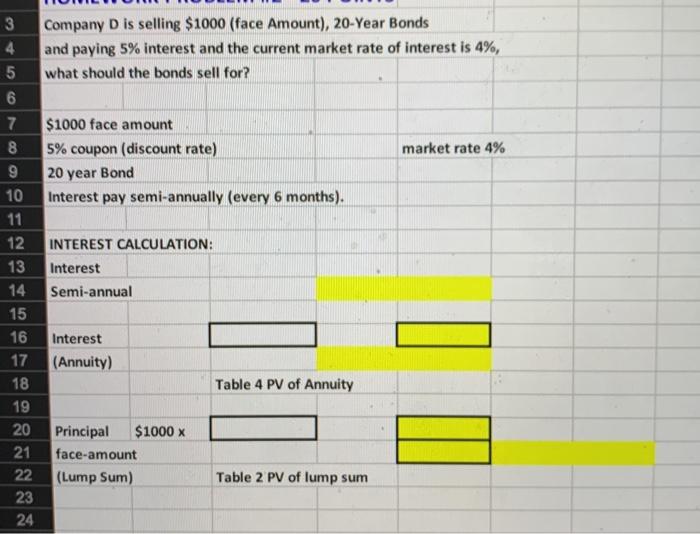

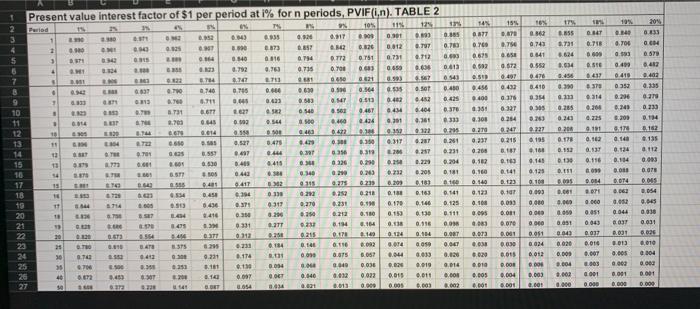

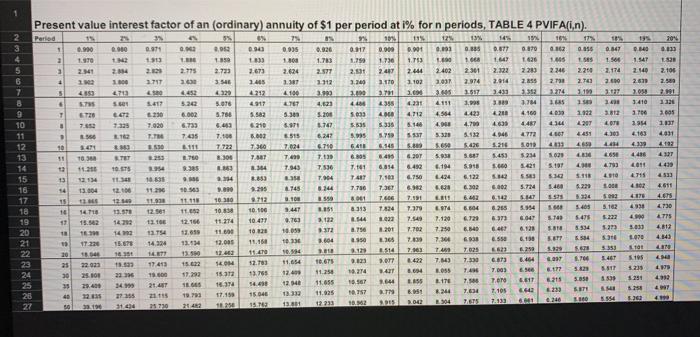

Bond Values Determining Bond Prices HOMEWORK PROBLEM 1 - 20 POINTS Company b is selling $1000 (face Amount), 20-Year Bonds and paying 5% interest and the current market rate of interest is 6%, what should the bonds sell for? market rate 6% $1000 face amount 5% coupon (discount rate) 20 year Bond Interest pay semi-annually (every 6 months). Interest Calculation: Interest Semi-annual Interest D 1 2 3 4 5 6 7 18 19 20 21 22 23 24 25 26 27 28 (Annuity) Table 4 PV of Annuity Principal face-amount Lump sum) Table 2 PV of lump sum 29 Company D is selling $1000 (face Amount), 20-Year Bonds and paying 5% interest and the current market rate of interest is 4%, what should the bonds sell for? market rate 4% 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 $1000 face amount 5% coupon (discount rate) 20 year Bond Interest pay semi-annually (every 6 months). INTEREST CALCULATION: Interest Semi-annual Interest (Annuity) Table 4 PV of Annuity 19 20 21 22 23 24 Principal $1000 x face-amount (Lump Sum) Table 2 PV of lump sum Present value interest factor of $1 per period at i% for n periods, PVIF(1,n). TABLE 2 115 105 NA 12 204 10% VE Period . 330 0.017 1995 TO 8.750 1 05 0.14 0718 T . 6.373 0816 0.963 SED 0.85 6.731 6.624 0.526 6.700 0:53 06 0.579 04 10 S 6 0.885 0.789 0.03 0.413 6543 0.143 8.30 0540 0.792 0107 TIS 0.045 0.857 74 0.735 ors1 0683 0.79 . 0.60 . 0.034 ME OTT 0.700 40 . ES 0.30 0.312 0.731 0.650 3.993 0.535 0.402 0.434 30 0.872 6.491 16% 236 0.743 8.641 0.552 0416 8.410 0314 305 0263 0.419 O DEO 14% 0877 0.16 0.675 0.502 .. 6.456 0.400 0.35 2.300 02 0.237 0.200 . LOS CD 140 6.71 0.40 0.33 E 0.50 141 37 0.314 0.264 0.25 CED 0.000 0.03 a 2 544 RE 0.403 0335 0.21 0.233 0.114 0.564 0.013 9.467 434 0.412 0.404 6 0503 540 500 0.40 0.49 . 3731 2.70 TOS 0.215 0.361 6:14 WE GE LE 0.28 6.249 5.200 14 0.14 0.124 8.475 0.445 2014 . 3559 0.530 08 . 0.5 OST 47 405 0.44 18 13 6.460 0.42 0.00 3 326 6.650 os . a. 0.137 176 03 6.214 0.247 0.215 B.18 0.13 0.141 2 123 0.317 10 0.14 TO . 0.350 0.312 020 ON 0.239 62 2.217 1.223 305 10 23 6.418 04 0312 0.330 9 10 11 12 13 14 15 10 17 18 10 20 21 22 23 24 25 26 3.57 0.200 0.17 0.152 0.13 . . 0.001 0.000 6.195 6.100 0.14 0.125 0.100 0.003 080 30 0 145 0213 . 0.333 0.25 0.251 0.231 0.24 0.181 160 0.141 0.125 0.111 OOM 0.00T GET 0.00 0.014 19 0.116 09 0.014 PE 3.182 1135 112 0.003 0.078 0045 054 9.045 0.00 0.031 0458 0.162 0.160 2.140 0.123 0.100 9.695 08 16 17 554 ES 6 60 0.94 0.37 8.200 0.18 0.17 0.153 114 30 0218 0.90 0.180 0.270 0.250 0.231 0.212 MES 8.200 DIE NO 0231 0.138 8.134 0043 1600 0.033 0.01 0.00 0.001 0.00 0.000 0.000 0031 0024 0.000 094 . 0.012 0.041 0037 0.03 013 0.005 G. 0.001 0.000 0.343 564 0124 w 0.017 0331 0112 6230 0.114 30 25 063 0.010 VERO 14 0.16 130 0.118 0.104 das 0.033 0.019 0.011 003 BAT 13 . 30 15 TA 700 6.72 6.100 082 6.067 0.036 0.022 0.000 ES 0.013 . . Da 0.005 . 9.211 5.11 1 BORT W 375 340 0.012 0.013 TO 0.074 04 0.020 0.015 00 0.014 0.024 2010 @ 304 0.000 0001 0.000 0.011 0.000 0.004 012 0.000 0.003 2.00: 0.020 0.001 2004 0.000 0.000 0.007 2003 0.001 dose 40 0.540 007 0.654 0.008 2002 4 3.834 Present value interest factor of an (ordinary) annuity of $1 per period at i% for n periods, TABLE 4 PVIFA(1,n). LE 19 115 0.000 0650 950 B. 0.935 . 2013 0911 1913 55 2013 1350 2723 3.540 4320 0.943 09 2.673 3.485 1.153 101 0.00 1.730 247 110 121 0.003 1.00 2.402 103 1.800 2.624 3.381 2141 D.UTT 1. 2.322 2014 E T 2.775 30 1668 2301 2.974 2444 1103 1 0.70 1626 2280 2.14 3.353 3.784 4160 0.54 1 56 2.174 2.000 3.17 14 TOT 1.000 17 &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts