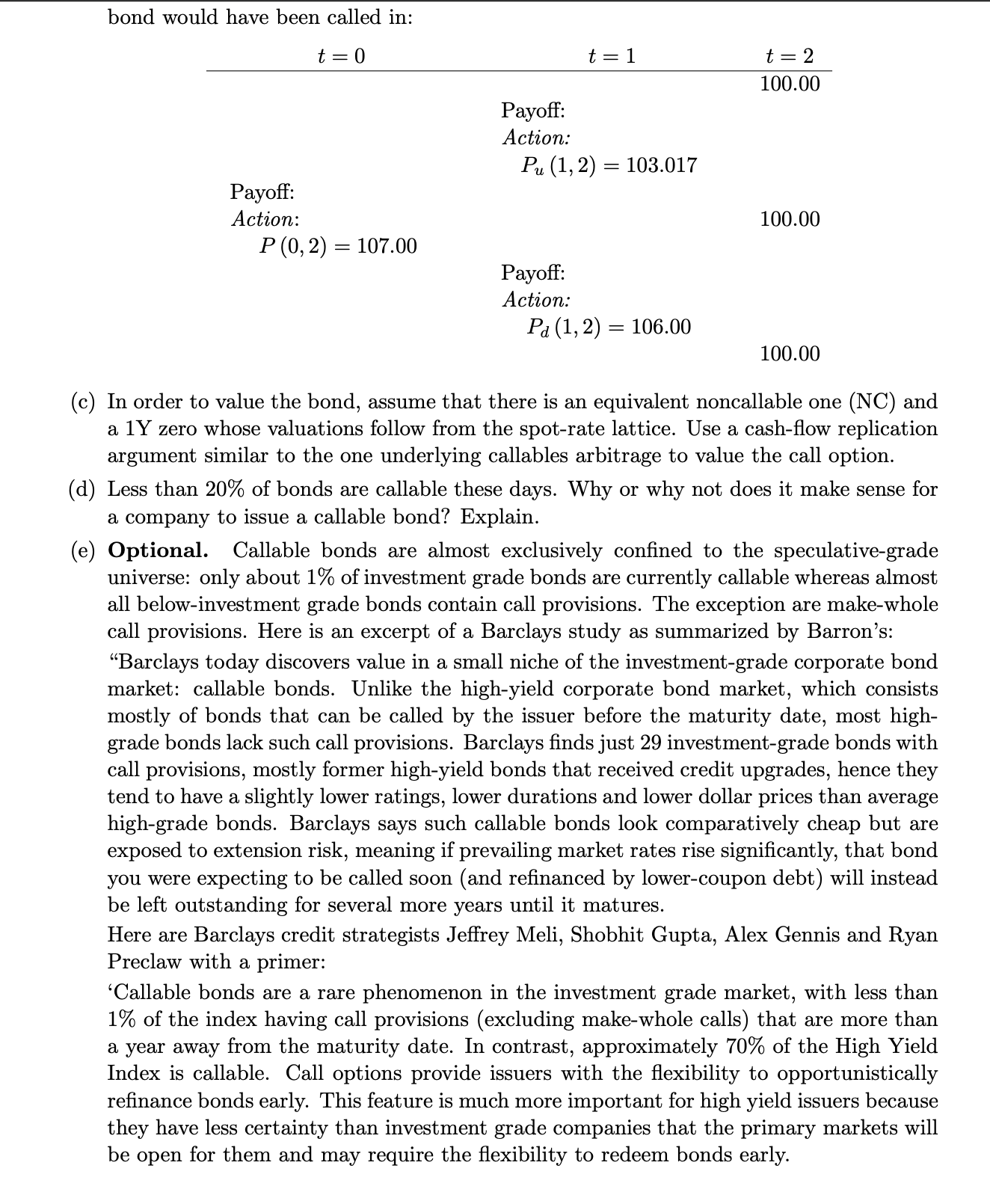

Question: bond would have been called in: t = 0 t = 1 t = 2 100.00 Payoff: Action: P (0,2) = 107.00 Payoff: Action:

bond would have been called in: t = 0 t = 1 t = 2 100.00 Payoff: Action: P (0,2) = 107.00 Payoff: Action: Pu (1, 2) = 103.017 Payoff: Action: 100.00 Pa (1,2) = 106.00 100.00 (c) In order to value the bond, assume that there is an equivalent noncallable one (NC) and a 1Y zero whose valuations follow from the spot-rate lattice. Use a cash-flow replication argument similar to the one underlying callables arbitrage to value the call option. (d) Less than 20% of bonds are callable these days. Why or why not does it make sense for a company to issue a callable bond? Explain. (e) Optional. Callable bonds are almost exclusively confined to the speculative-grade universe: only about 1% of investment grade bonds are currently callable whereas almost all below-investment grade bonds contain call provisions. The exception are make-whole call provisions. Here is an excerpt of a Barclays study as summarized by Barron's: "Barclays today discovers value in a small niche of the investment-grade corporate bond market: callable bonds. Unlike the high-yield corporate bond market, which consists mostly of bonds that can be called by the issuer before the maturity date, most high- grade bonds lack such call provisions. Barclays finds just 29 investment-grade bonds with call provisions, mostly former high-yield bonds that received credit upgrades, hence they tend to have a slightly lower ratings, lower durations and lower dollar prices than average high-grade bonds. Barclays says such callable bonds look comparatively cheap but are exposed to extension risk, meaning if prevailing market rates rise significantly, that bond you were expecting to be called soon (and refinanced by lower-coupon debt) will instead be left outstanding for several more years until it matures. Here are Barclays credit strategists Jeffrey Meli, Shobhit Gupta, Alex Gennis and Ryan Preclaw with a primer: 'Callable bonds are a rare phenomenon in the investment grade market, with less than 1% of the index having call provisions (excluding make-whole calls) that are more than a year away from the maturity date. In contrast, approximately 70% of the High Yield Index is callable. Call options provide issuers with the flexibility to opportunistically refinance bonds early. This feature is much more important for high yield issuers because they have less certainty than investment grade companies that the primary markets will be open for them and may require the flexibility to redeem bonds early. With the average all-in yield of the Barclays Corporate index dipping back under 3%, the call options of most callable bonds in the index are deep in the money. As a result, such bonds have very little extension risk. However, many callable bonds still trade at a significant discount to comparable bullet bonds. We believe this discount is too high given their low extension risk and see value in the investment grade callable bond sector.' (Barron's, May 30, 2014) " Why are less than 1% of investment-grade bonds callable? Why are call provisions confined to the speculative-grade bond market? What are 'make-whole call' provisions and how do they differ from regular call provisions? Why would callables trade at a significant discount to comparable non-callable bonds? Given that Barclays think that the discount is too high, what must be true? 3. Convertibles Arbitrage. Paladin Energy Ltd, a Canadian-Australian mining company 100+20 (TSX, ASX: PDN), just completed a convertible bond offering. Its stock price was C$1.739 at close of trading on TSX on April, 20 2012 or US$1.752/A$1.690 based on exchange rates at the time of fixing the reference price. Here is recent press coverage of the transaction: "Paladin Energy Ltd. has completed its issue of senior, unsecured convertible bonds due 2017. The convertible bonds carry a coupon of 6.00% per annum payable semi-annually in arrear and are convertible into Paladin shares at an initial conversion price of $2.19 (U.S.) per share, representing a conversion premium of approximately 25% above the reference price of Paladin shares at the time of pricing. Paladin has the right to redeem all outstanding convertible bonds at their principal amount plus accrued interest in certain circumstances including, on or after May 14, 2015, if the Paladin share price, translated into U.S. dollars at the prevailing exchange rate, exceeds for a specified period of time 130% of the conversion price. The payment and settlement date of the convertible bonds is expected to be on or around April 30, 2012. The proceeds of the issue will be used in part to finance Paladin's concurrent tender offer to acquire up to $200-million (U.S.) of its $325-million (U.S.) issue of convertible bonds due in March, 2013, with any amount not applied to the tender offer being utilized to strengthen the company's balance sheet and pursue future growth opportunities. The joint bookrunners and joint lead managers are Barclays Bank PLC, Royal Bank of Canada and UBS AG, Australia branch. The sole global co-ordinator is Barclays." (Reuters, April 23, 2012) "AFRICA-focused uranium miner Paladin Energy says it has significantly strengthened its balance sheet after a convertible bond issue that raised $US274 million ($A266.50 million) from investors. The convertible bonds were purchased mainly by investors in Canada and Australia, where the miner is dual-listed. The amount raised was at the top end of company expectations, with Paladin having earlier told the Australian Securities Exchange that it was to raise $US225 million ($A218.84 million) with the option of upsizing that amount by and extra $US50 million ($A48.63 million). The capital raising has placed Paladin in a strong position to pursue growth opportunities and to optimise the benefit to the company of the strong interest being shown by various potential strategic partners," managing director John Borshoff said in a statement today. Paladin has two mines, Langer Heinrich in Namibia and Kayelekera in Malawi, with exploration projects in Australia and Canada." (Herald Sun, April 24, 2012). Fully Paid Ordinary Shares Paladin Capital Structure Unlisted Options (AU$2.54 and AU$5.37) Unlisted Share Rights 5Y Convertible: Mar '13, 5%, US$6.59 per share conversion price 5Y Convertible: Nov '15, 3.625%, US$5.66 per share conversion price 835,645,290 7,503,491 7,102,021 US$325M US$325M (a) Decompose convertible bonds into their constituent parts and explain their payoff profile by drawing the relevant diagram. (b) Analyze the terms of the Paladin offering. How well has Paladin been doing? What is the conversion ratio? Is the bond callable? If so, at what conditions? (c) Paladin seems to have issued a lot of convertible bonds in the past. Analyze their funding strategy and the implications for investors. What is the purpose of the convertible offering? Why does it have to happen now? What do the repeated convertible offerings signal to investors? Why might investors welcome a convertible rather than a plain-vanilla bond in Paladin's case? (d) Comparable bonds without convertibility traded at a yield of 6.32% on April, 20, 2012. Assuming that the Paladin convertible came to market at par, price the conversion option. (e) Working for a hedge fund in convertibles' arb, you run your sophisticated models, which take into account the bond's various provisions and their interaction, on the Paladin offering to find that the optionalities are worth 14.98. What should have been the bond's issue price? How would you use the price discrepancy in your favor? Describe your arbitrage strategy. (f) Optional. Discuss the economic rationale behind convertible bonds and how they allow firms to mitigate conflicts of interest between shareholders and bondholders.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts