Question: BONDS, FIXED INCOME SECURITIES & CALCULATIONS Practice Questions - B 1. If you invest $500 at the end of the first year, $500 at the

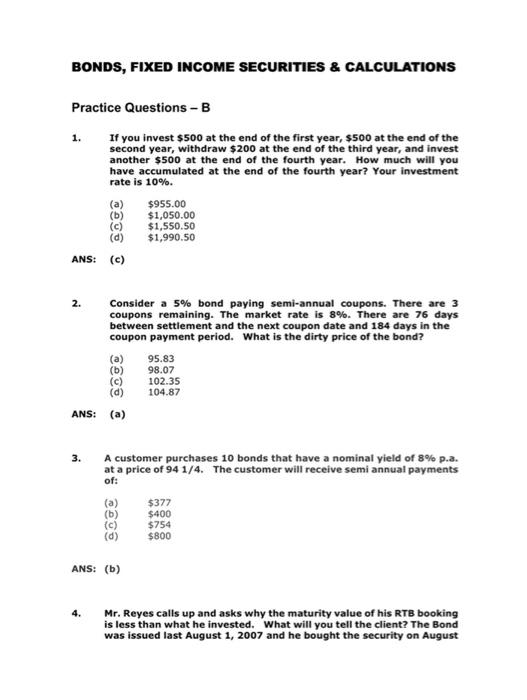

BONDS, FIXED INCOME SECURITIES & CALCULATIONS Practice Questions - B 1. If you invest $500 at the end of the first year, $500 at the end of the second year, withdraw $200 at the end of the third year, and invest another $500 at the end of the fourth year. How much will you have accumulated at the end of the fourth year? Your investment rate is 10%. (a) (b) $955.00 $1,050.00 (c) (d) $1,550.50 $1,990.50 (c) Consider a 5% bond paying semi-annual coupons. There are 3 coupons remaining. The market rate is 8%. There are 76 days between settlement and the next coupon date and 184 days in the coupon payment period. What is the dirty price of the bond? (a) 95.83 (b) 98.07 102.35 (d) 104.87 ANS: (a) 3. A customer purchases 10 bonds that have a nominal yield of 8% p.a. at a price of 94 1/4. The customer will receive semi annual payments of: (a) $377 (b) $400 (c) $754 (d) $800 ANS: (b) 4. Mr. Reyes calls up and asks why the maturity value of his RTB booking is less than what he invested. What will you tell the client? The Bond was issued last August 1, 2007 and he bought the security on August ANS: 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts