Question: Bonds Payable Background Information Silver Company issues bonds payable on January 1, 2019. Here are the details: stated interest rate = 4%; market interest rate

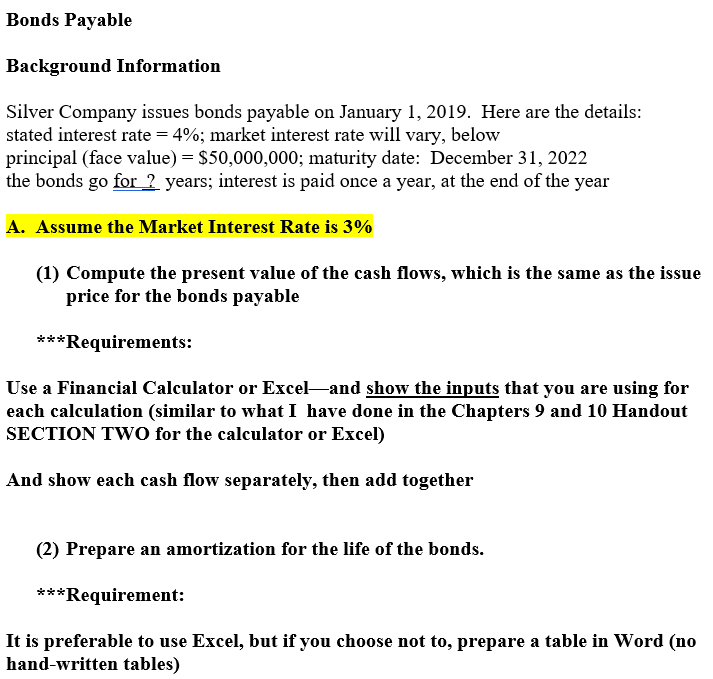

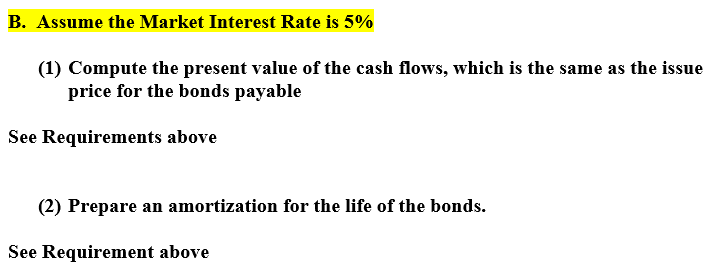

Bonds Payable Background Information Silver Company issues bonds payable on January 1, 2019. Here are the details: stated interest rate = 4%; market interest rate will vary, below principal (face value) $50,000,000; maturity date: December 31, 2022 the bonds go for 2 years; interest is paid once a year, at the end of the year A. Assume the Market Interest Rate is 3% (1) Compute the present value of the cash flows, which is the same as the issue price for the bonds payable *Requirements: Use a Financial Calculator or Excel-and show the inputs that you are using for each calculation (similar to what I have done in the Chapters 9 and 10 Handout SECTION TWO for the calculator or Excel) And show each cash flow separately, then add together (2) Prepare an amortization for the life of the bonds **Requirement: It is preferable to use Excel, but if you choose not to, prepare a table in Word (no hand-written tables) B.Assume the Market Interest Rate is 5% (1) Compute the present value of the cash flows, which is the same as the issue price for the bonds payable See Requirements above (2) Prepare an amortization for the life of the bonds. See Requirement above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts